The Legal and General share price has done relatively well as investors buy the dip in the past few days. The LGEM stock is trading at 252p, which is slightly above this month’s low of 235p. However, the company’s shares have fallen by more than 18% from the highest point this year. The firm has a market cap of more than 14.65 billion pounds.

Legal and General is a leading British company that provides a number of solutions such as insurance and asset management in the UK and other countries. It is a giant company that generates more than 45 billion in annual revenue. It has over 1.45 trillion pounds in assets under management (AUM), making it the biggest asset manager in the UK.

Legal and General is beloved because of its strong dividend yield. The company has a dividend yield of 7.31%, which is one of the highest in the FTSE 100 index. Its forward yield is 11%, while the company has a relatively strong payout ratio.

L&G stock has underperformed in the past few weeks as concerns about interest rates remain. The firm does well in a period of high-interest rates. There are signs that the Bank of England (BOE) will start slowing down its hiking cycle. Another factor is that the performance of equities impacts its asset management business. It is estimated that a 25% drop in the equities market would lead to a 500 million drop in pre-tax profits.

Legal and General share price forecast

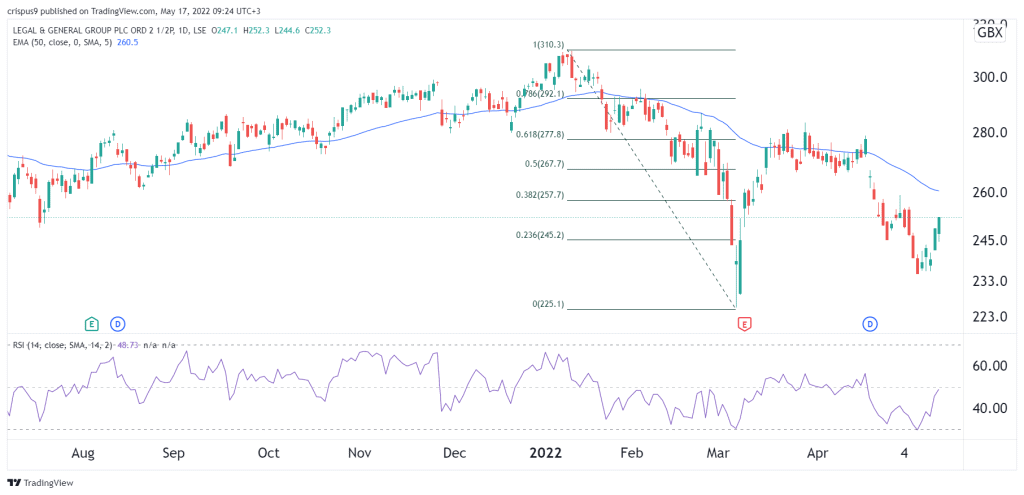

The daily chart shows that the LGEN share price has been in a strong recovery mode in the past few days. It has risen in the past five days straight. However, the shares remain below the 25-day moving average while the Relative Strength Index (RSI) has moved close to the neutral level of 50. In addition, the stock has moved between the 23.6% and 38.6% Fibonacci retracement level.

The stock will likely continue rising in the coming days as investors target the 25-day moving average level at 260p. A drop below 245p will invalidate the bullish view.