The Koss share price has been in a strong bearish trend in the past few weeks as demand for the company’s products wanes. The shares are trading at $6.45, which is about 95% below the highest point in 2021. As a result, the company’s market cap has declined to just $58, making it a relatively small-cap company.

The Koss stock price jumped by more than 5% in extended hours after the company published relatively strong quarterly results. In its report, the company said that its sales rose by 16.2% in the third fiscal quarter to $4.6 million. As a result, the company’s net income rose to $403,204, which was better than the net loss of $474,168 that the company made in the previous quarter.

At the same time, the company’s revenue for the nine months to March 31st fell by 5% to $14.12 million, while its net income rise to $882,814. The firm attributed the decline in revenue to several domestic distributors and its decision to withdraw its non-branded models from a retailer. However, this weakness was offset by the strong performance of its direct-to-consumer business. The CEO said:

“Gross margin improvement for the three and nine months ended March 31, 2022, can be attributed to last year’s shift away from traditional mass retail stores, which has resulted in a more favourable mix of product within growing market classes.”

So, what next for the Koss stock price?

Koss share price forecast

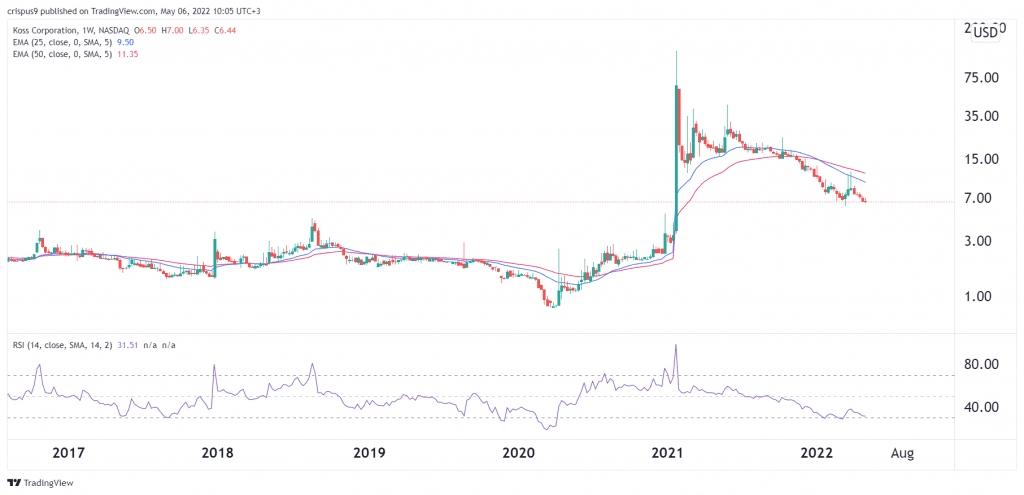

The weekly chart shows that the Koss stock price has been in a strong downward trend in the past few days. The shares ended the day at about $6.44. It rose by more than 5.43% in extended hours after the company published strong results.

Still, the stock has moved below all moving averages while the Relative Strength Index (RSI) has moved to the oversold level. A closer look reveals that it has formed a falling wedge pattern.

Therefore, there is a likelihood that the stock will have a bullish comeback in the near term. If this happens, the next key resistance to watch will be at $8.