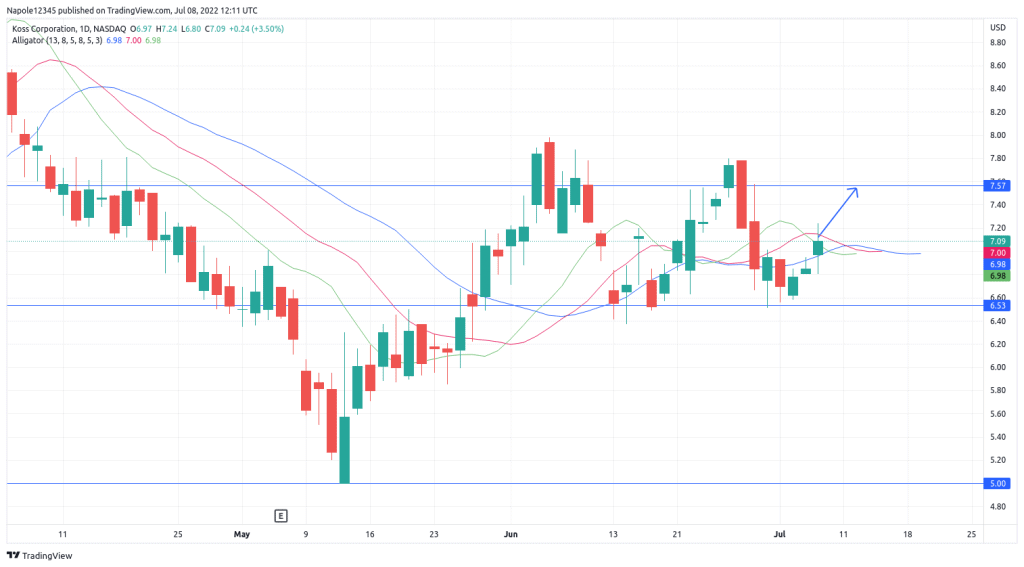

Koss share price closed yesterday’s trading session up by 3.5 per cent. The surge extended a recent share price rally to three consecutive days. Koss is also up by 5 per cent this week, reversing an aggressive trend that started last week when prices dropped by 10 per cent.

Koss Financial Reports

With a market capitalization of $64 million and a price-to-earnings ratio of $57, Koss has performed relatively well in the past few months. In its income statement, the company has continually improved throughout the year, recording a revenue of $4.37 in the first quarter of 2022, with a net loss of $99,000. However, the second quarter resulted in much better results, where the company recorded a revenue of $4.42 and a net income of $578,000.

The latest data as of the second quarter of 2022 also shows the company has a strong balance sheet. The financial report indicated that Koss had $28.53 in total assets. The company also had liabilities worth $6.82 million. The ratio of debt to assets stood at 23 per cent, leaving it in a good financial position, where debts cannot impact its day-to-day running.

Koss Share Price Prediction

Koss’ share price is looking poised to continue with the strong bullish trend that started late last month. The company is already up by 2 per cent this month, after it closed June with a drop of 0.14 per cent, despite dropping by 10 per cent during the month.

In yesterday’s trading session, Koss’ share price rose by 3.5 per cent, continuing a bullish trend that had started two days before. Despite the bullish move, the company is still being impacted by the current economic factors, such as high inflation rates, which have seen its headphones struggle in the markets.

Therefore, if the current conditions continue, there is a high likelihood that the markets will start moving sideways. This is based on the fact that, before the recent bullish move, the prices had 11 per cent in two days, between June 28 and 29. Since then, the prices have yet to recover from the drop. Therefore, the best-case scenario for the share price is a trade above the $7.5 price level.

Koss Daily Chart