JD Sports share price soared to an all-time high after the company sent strong revenue guidance even as it warned about the impact of the lockdowns. The shares are trading at 889p, which is slightly below the intraday high of 923p. This makes JD the best-performing FTSE 100 company today. It is followed by Pershing Square Holdings, Standard Life Aberdeen, and Associated British Foods.

What happened: JD Sports is having an excellent run. In a note today, the firm said that its total revenue in the past 22 weeks rose by 5% from the same period last year. This gain was mostly because of the strong penetration of its e-commerce platforms.

Also, the firm expects that its profit will be better than what it had guided before. Precisely, it sees this revenue soaring to about £400 million. Still, it warned that its stores could be closed until April this year as the number of cases continues rising.

What else: It has been an excellent time for JD Sports. A few weeks ago, the company acquired Shoe Palace, an American retailer in a $325 million deal. This deal will help it strengthen its American business that also includes JD and Finish Line. And today, it announced that it would acquire Wellgosh, a small sportswear designer.

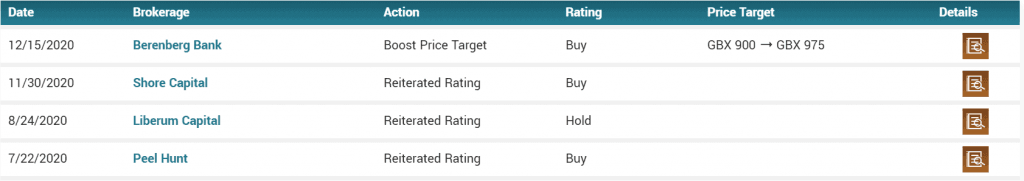

What next for JD.L share price: JD Sports share price has been having a strong momentum recently. It has risen by more than 226% from its lowest level in 2020. And analysts are still optimistic about its performance. In their latest estimate, analysts at Berenberg Bank boosted their target to 975p, which is substantially higher than the current price. Those at Shore Capital, Liberium, Peel Hunt, and Morgan Stanley are also optimistic.

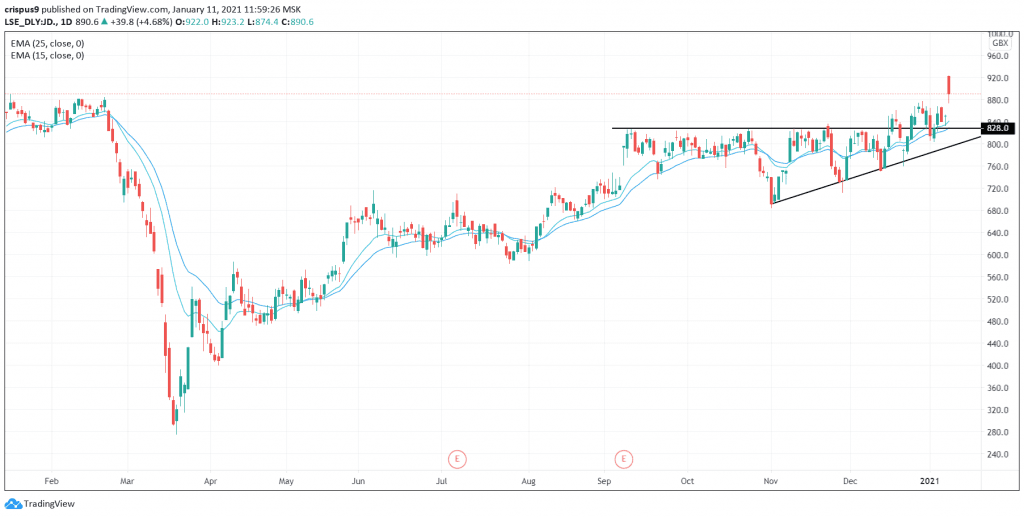

JD Sports Share Price Technical Analysis

Turning to the daily chart, we see that JD share price has been in an upward trend. This month, it managed to move above the upper line of the ascending triangle pattern that’s shown in black. Also, the rally is supported by the 25-day and 15-day exponential moving averages.

Therefore, in my view, the company’s shares will continue rising as bulls aim for the next resistance at 1,000p. However, a drop below the support at 828p will invalidate this trend.

Don’t miss a beat! Follow us on Telegram and Twitter.

JD Sports Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.