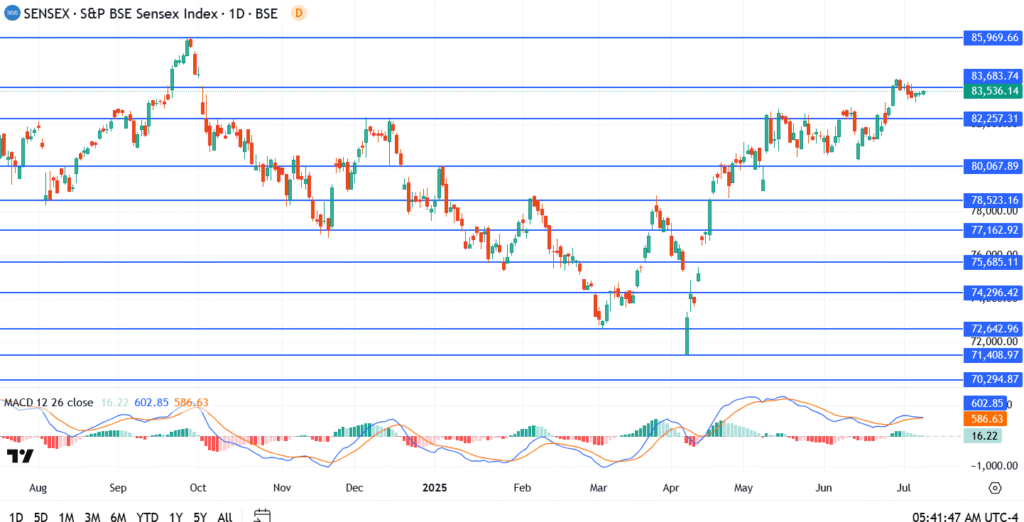

The BSE Sensex held firm around 83,536.14 on Monday’s close, managing to stay in positive territory despite global headwinds and chatter around a possible Bharat Bandh on July 9. The index is now pressing just below 83,683, a key resistance zone that has capped the last few rallies.

While domestic sentiment remains strong, traders are increasingly watching developments out of the US, where Donald Trump’s tariff rhetoric is shaking up risk appetite across emerging markets.

Trump Tariffs, US-India Deal in Focus

Global markets opened the week on edge after fresh reports suggested former US President Donald Trump could reimpose sweeping tariffs if reelected. Indian equities didn’t completely shrug it off, especially with bilateral trade deals still in flux.

The Nifty 50 and Sensex spent most of today angebound as investors weighed the possible impact on sectors like IT, pharma, and export-heavy midcaps.

Bharat Bandh on July 9: Will Markets Stay Open?

The other overhang is domestic, traders are closely watching the proposed Bharat Bandh on Tuesday, July 9, though as of now, both NSE and BSE are expected to operate normally. Volumes could still take a hit, especially during opening hours.

BSE Sensex Technical Snapshot

- Current Close: 83,536.14

- Resistance Levels: 83,683.74, then 85,969.66

- Support Zones: 82,257.31, then 80,067.89

Outlook

The Sensex is holding up surprisingly well, considering the external noise. With Trump’s tariff threats looming and a nationwide bandh in play, the index’s tight range signals caution rather than weakness.

If bulls can reclaim and close above 83,683 this week, the door to 85,969 opens. Until then, rangebound moves may dominate ahead of earnings and policy catalysts.