The Nifty 50 inched up on Monday, adding 0.58% to close at 24,504.95 as traders balanced selective buying in banks and IT stocks with mild selling in defensives. The index traded in a narrow range through the day, holding above the 24,350 floor and staying within striking distance of last week’s highs.

The session’s tone was steady rather than explosive, a sign that while sellers remain on the sidelines, buyers are equally unwilling to chase prices aggressively without fresh triggers. With the earnings calendar heating up, the market’s focus has shifted to stock-specific action rather than index-wide moves.

Banking and IT Stocks Lift Nifty, FMCG Drags

Private banks were at the front of the pack, with ICICI Bank and HDFC Bank climbing after management signalled steady credit growth.

FMCG counters such as Hindustan Unilever and ITC came under selling pressure as investors booked profits amid ongoing margin worries. Metals and energy shares traded without clear direction, with oil-linked names tracking the day’s swings in crude prices.

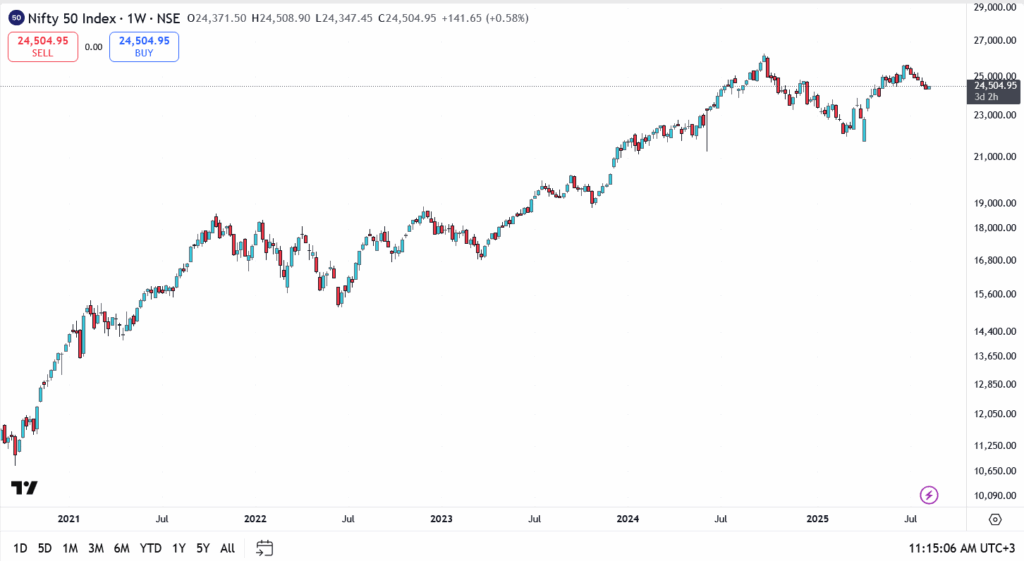

Nifty 50 Chart Analysis

- Current price: 24,504.95

- Immediate resistance: 24,550, then 24,800

- Support: 24,350, then 24,200

The index remains above its rising trendline from the May lows, keeping the broader bullish bias intact. A close above 24,550 could invite another test of 24,800, while a break under 24,350 would tilt the near-term bias back toward 24,200.

Outlook: Quiet Grind Before the Next Catalyst

This is not a breakout, but it’s equally far from a breakdown. The Nifty continues to trade within its established band, with domestic flows cushioning global uncertainty. Unless a major earnings surprise or macro shock hits, the index looks set for more choppy, range-bound trade in the short term. For now, bulls have the upper hand, but patience is wearing thin on both sides.