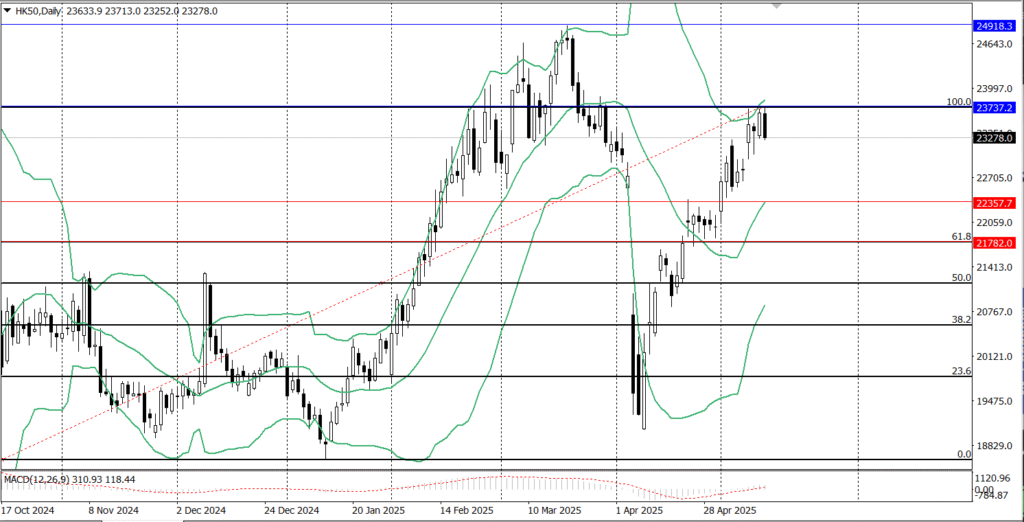

- Technically, the index faces strong resistance at 23,737.2, with potential for either breakout or bearish reversal.

- Markets remain sensitive to trade updates, influencing investor sentiment and risk appetite.

The Hang Seng Index (INDEXHANGSENG: HSI) represents a market capitalization-weighted index that tracks the performance of the largest companies listed on the Hong Kong Stock Exchange.

This index is considered to be the benchmark equity market index for Hong Kong and an indicator for the Hong Kong economy and barometer for asian markets more generally.

Today’s asian market had been mixed session as investors awaited US-China trade war updates. So the Hang Seng index fell 0.24%, while its tech index fell 0.60% in response to the Hang Seng mainland properties index dropping 0.49%

On the other hand, Tencent earnings weren’t as good as expected, so its stock went down a bit 0.48%, as same as Alibaba’s stocks fell slightly 0.38% because people are waiting for their earnings report today, May 15th.

Meanwhile, auto stocks had a mixed morning; some stocks went up and others fell. Li Auto and BYD companies advanced 0.71% and 3.33%, while NIO fell 1.55%.

The Hang Seng Technical levels:

Technically, the Hang Seng Index (HK50) is trading at the time of writing under a strong resistance level of 23737.2, so if the index can make w breakout above this level, we can reach higher levels ahead to its all-time high at 24918.3.

On the flip side, if the index remains under the pressure of the mentioned resistance level, it could be exposed to a bearish trend reaching lower levels to 22357.7 and then 21782.0.

All eyes are on the US-China trade Updates:

Markets nowadays are highly sensitive to any updates related to the US-China trade. So, any positive progress in this deal may increase the risk appetite for the investors, supporting stocks trading and subtracting flows from the safe-haven assets.

If any negative announcement related to the US-China trade deal arises, the will affect oppositely to the stock markets. because this will lead to less risk appetite, less stock buying, and easing flows into safe-haven assets.

Investors should be awake and responsive to any market updates and central bank signals.