- The HSBC share price took a hit on Tuesday after BNP Paribas downgraded the stock, taking it off Monday's 18-month highs.

The HSBC share price has taken a hit this Tuesday following a price downgrade by Exande BNP Paribas. The stock had performed creditably in Monday’s session, gaining 6.13% after the bank reported solid earnings for the second quarter of 2022.

The bank announced interim results on 1 August, showing a 13% gain in pretax profits as rising interest rates, increased income from its currency trading activities and a tax deferment helped the bank to rake in $5.97 billion in Q2 2022. Estimates had been for a pretax profit of $4.96 billion. The results sent the HSBC share price to the highest point in 18 months.

However, the joy was short-lived as the stock opened lower this Tuesday after BNP Paribas downgraded the stock from “outperform” to “neutral,” a move that sent the stock down from session highs after it had opened deeply south on Tuesday.

The downgrade means that the HSBC share price target now has an 8.5% implied downside, having been cut from 444p to 400p. Exane BNP Paribas analysts say stricter regulation and extended challenging market conditions will render the bank’s dividend policy unsustainable. The HSBC share price is currently down 2.07%.

HSBC Share Price Outlook

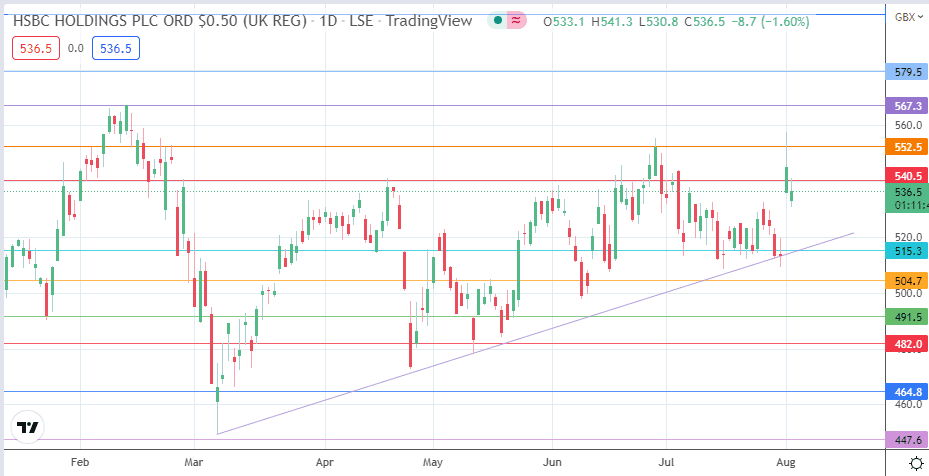

Tuesday’s decline has sent the stock in a pullback mode, following the rejection at the 540.5 resistance. The price setup appears to be forming a shooting star candle, potentially setting up a move to the south. This move would have to challenge the psychological support at 530.0, which sits just above the highs of 1 April and 27 July. Below this level, the ascending trendline and the 520.0 price mark (29 July high) form an additional pivot that must give way before harvest points at 504.7 and 491.5 (23 May low) are seen.

On the flip side, the bulls need to clear the 540.5 resistance before 552.5 (3/22 February highs) becomes available as a new target. Above this level, the 567.3 resistance mark (11 February high) forms an additional harvest point for the bulls. The 23 August 2019/31 October 2019 lows at 579.5 are an extra barrier that forms a new target if 567.3 is uncapped.

HSBC: Daily Chart