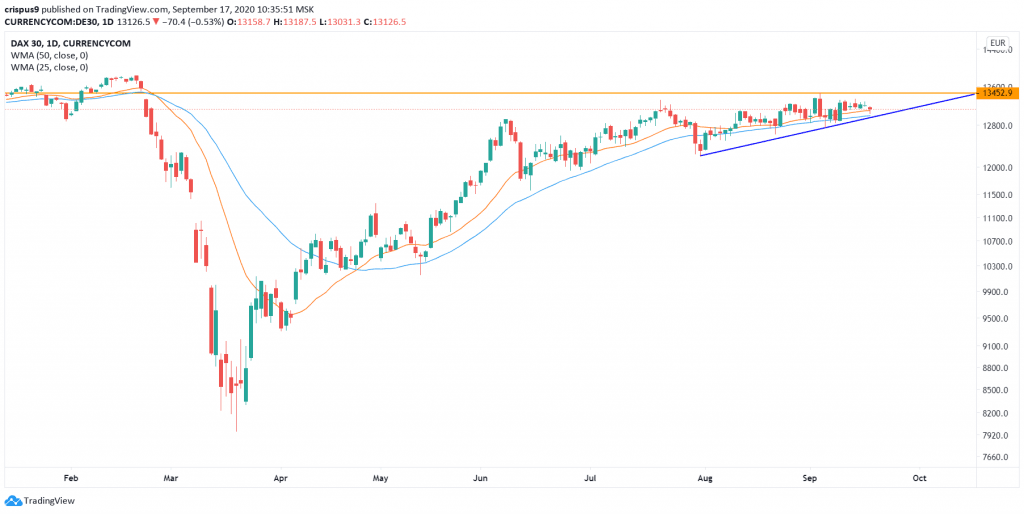

- The DAX index looks set for a breakout as the ascending triangle pattern approaches the tipping point. This could happen in the next few days

The DAX index is down by more than 1.45% as the sell-off in global stocks accelerates. The index is trading at €13,057, which is slightly lower than the yesterday’s high of €13,265. Also, all stocks in the index are in the red today. Other European indices are also struggling, with the FTSE 100, CAC 40, and Stoxx 50 falling by more than 1%.

The DAX index is falling as part of the global sell-off in global stocks after the Federal Reserve meeting. In the rate decision, the bank decided to leave rates unchanged. In its dot plot, 13 of the 17 members of the bank said that they see rates remaining at the current level for the next three years. As such, the decline in the stocks is likely because of the buy the rumour and sell the news situation.

The DAX is also falling because of some disappointing data from Europe. In a report today, the European Automobile Manufacturers Association said that new registrations dropped by more than 18% in August. That ended the recovery path experienced in the past three months.

The decline could be because the scrappage program by the French government ended in July. The program offered people $5,900 subsidies to buy new cars. This decline was worse than the 15% that analysts were expecting. Also, it means that sales are likely to drop by 20% this year.

The decline of the DAX index has been partially cushioned by the weaker euro. The euro has dropped by 0.30% against the US dollar, which is a good thing for German equities.

German automakers are among the worst-performing stocks in the DAX, mostly because of the weakness in the European car market. Volkswagen, Daimler, and BMW share prices are down by more than 2%. Continental, which supplies automakers has also dropped by more than 1.70%. Other top laggards in the DAX are RWE, Infineon, Deutsche Bank, and Muench Rueckvers.

DAX index technical outlook

The daily chart below shows that the DAX index has been in consolidation in the past few days. As a result, it has hit a resistance at €13,452 and formed an ascending triangle pattern. The pair is also slightly above the 50-day and 100-day weighted moving averages. Now, the triangle pattern is closer to the tipping point, which means that the index is likely to break out higher.

If it does, there is a likelihood that it will continue rising above the resistance of €13,452. On the flip side, a move below €13,000 will invalidate this trend. This price is at the intersection of the 50-WMA and the ascending trendline.

Start your trading journey with our free forex trading course and one-on-one coaching by traders and analysts with decades of experience in the industry.