- What is the outlook of the Hang Seng index? We explain whether it is a good investment and what to expect now that it has bounced back.

The Hang Seng index tilted upwards on Thursday as investors reacted to the latest interest rate decision by the Federal Reserve. The HSI index is trading at H$21,000, which is slightly above last week’s low at H$19,710. The performance mirrors that of other global indices like ASX 200 and Nasdaq 100 rose after the Fed decision.

Hong Kong rate hike

The Hang Seng index rose slightly after the FOMC decision. In it, the bank decided to hike interest rates by 0.50%, the biggest rate hike in over 22 years. Stocks and cryptocurrencies rose because the rate hike was in line with what most analysts were expecting. Unlike other major indices, the Hang Seng is highly sensitive to Fed hikes because Hong Kong has a pegged currency system. Therefore, in response to the hike, Hong Kong’s authorities also moved rates by a similar amount.

The Hang Seng has also performed well as investors predict that China will slow its crackdown on tech companies. This crackdown has helped to drag the index in the past few months as the value of tech giants has slumped. The best-performing company in the HSI was Budweiser, the brewer that published strong results.

It was followed by Xiaomi, Meituan, and Alibaba Health Information Systems. These shares have risen by more than 3%. Other tech giants like Alibaba, Lenovo Group, and JD have also performed well. On the other hand, the top laggards in the index are WuXi Biologics, Country Garden, and Sunny Optical.

Hang Seng forecast

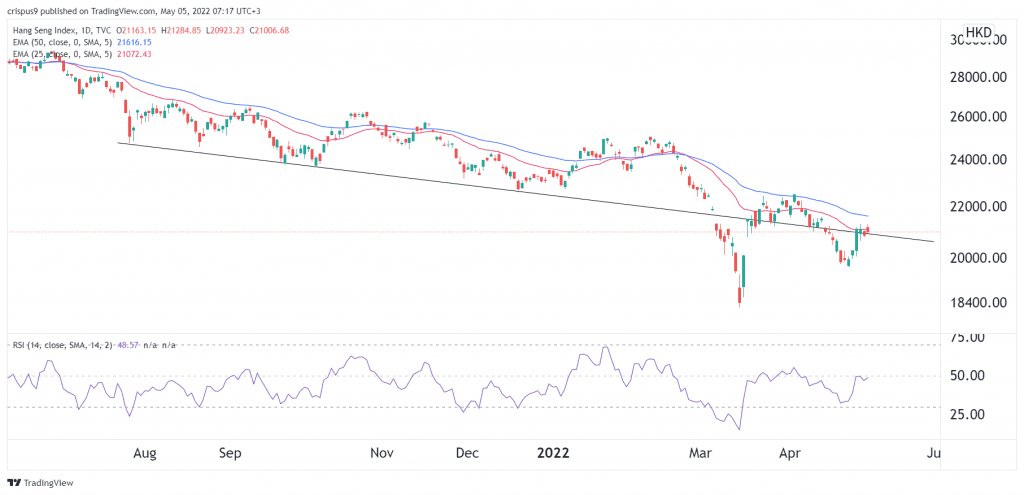

The daily chart shows that the HSI index has been in a slow recovery in the past few days. It has managed to move above the descending trendline shown in black. The index has also moved slightly below the 25-day and 50-day moving averages, while the Relative Strength Index has moved to the neutral level.

Therefore, the index will likely resume the bearish trend as investors position their portfolios to a high-interest rates ecosystem. If this happens, the next key support level to watch will be H$20,000. This will happen as investors avoid fighting the Fed. As a result, the current jump could be a dead cat bounce, which is usually short-lived.