- The Hang Seng index retreated sharply on Wednesday as fear of a recession spread globally. The HSI dropped to a low of H$21,538

The Hang Seng index retreated sharply on Wednesday as fear of a recession spread globally. The HSI dropped to a low of H$21,538, which was the lowest level since June 24th. This price is slightly lower than last week’s high of H$22,450. Other Asian indices also nosedived, with the Nikkei 225 falling by 1.50% and the Shanghai, China A50, and Nifty 50 falling by more than 1%.

Recession risks rise

Hong Kong stocks followed their American counterparts sharply lower on Wednesday as investors focused on the rising risks of a recession. Data published this week showed that manufacturing and services sentiment is falling globally as companies complain about the rising risks of doing business.

A major risk is coming from Europe, a continent that is trying to decouple from Russia. In Germany, the government is set to provide over $10 billion in bailouts for energy companies after Russia reduced its supply to the country. More energy companies are expected to go out of business in the coming months unless the government intervenes.

The Hang Seng index is also falling because of the hawkish central banks. The Federal Reserve has already hiked interest rates by 150 basis points and hinted that it will continue rising in the coming months. These actions have a direct impact on Hong Kong since the government pegs its currency to the US dollar. As such, the city’s central bank always follows into the footsteps of the Fed.

The worst-performing stocks in the Hang Seng are CNOOC, Haidilao, PetroChina, WH Group., and Jd.com. All these shares dropped by more than 4%. On the other hand, the top performers in Hang Seng are Techtrnic Industries, CSPC Pharma, Alibaba, and Link Real Estate among others.

Hang Seng forecast

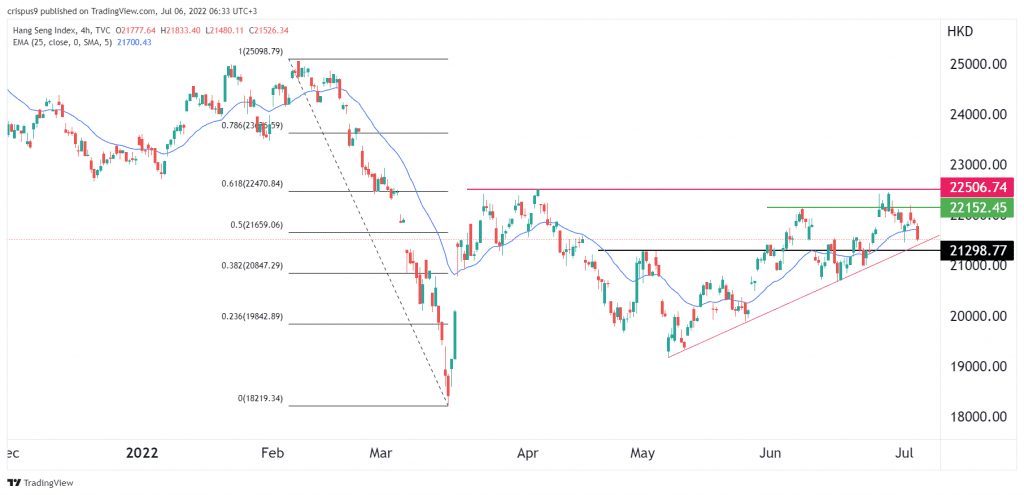

The four-hour chart shows that the HSI index found a strong resistance level at H$22,500 recently. It struggled to move above this level several times since April of this year. Now, the stock has moved below the 25-day moving average and the 50% Fibonacci retracement level. It is also approaching the important support at H$21,298.

Therefore, the outlook of the Hang Seng index is bearish, with the next key target being at H$21,000. On the flip side, a move above the resistance at H$22,150 will invalidate the bearish view.

HSI support and resistance levels

InvestingCube’s S&R indicator is a highly accurate tool that sends signals on key assets every day. It has an accuracy ratio of over 80%. The robot also has a bearish view on the Hang Seng index and has a target of H$21,530 followed by H$21,390. The stop-loss for this trade is at H$21,989. You can subscribe to this indicator here.