- Haleon share price is still in its price-discovery phase as investors assess the company’s fundamentals. What next for the HLN stock?

Haleon share price is still in its price-discovery phase as investors assess the company’s fundamentals. After crashing to a low of 285p after going public, the HLN stock has recovered to the current level at 307p. This recovery has helped push its total market cap to over 28.75 billion pounds, making it one of the biggest publicly-traded companies in London.

Is HLN a good buy?

Haleon is a leading consumer health business that focuses on oral health, respiratory health, pain relief, and vitamins, minerals, and supplements. The company owns some of the leading brands in these industries like Sensodyne, Parodontax, and Aquafresh. It competes with companies like Colgate-Palmolive, Abbott Laboratories, Procter & Gamble, and Eli Lilly among others.

Haleon, like other consumer-facing products, has been under intense pressure in the past few months as inflation has surged. The firm is facing higher cost of doing business while demand for its products has declined as people scale back their consumption.

In July, Haleon published its trading update for the six months to June 30th. Its revenue increased by 13.4% to £5.1 billion. Its organic revenue rose by 11.6%, helped by price and volume mix. Some of its top performing products in the period were Theraflu, Panadol, and Centrum.

In its outlook, the company said that it organic revenue for the first half of the year will be between 6% and 8%. It expects its adjusted operating margin for the year to be slightly down at constant currency while synergies with Pfizer will lead to savings of over £175 million.

Haleon is a good investment because of its strong brand and the fact that the company has a strong market share in its key industries. Historically, spin-offs tend to do better than the parent companies. For example, PayPal has outperformed eBay while Mondelez has done better than Kraft.

Haleon share price forecast

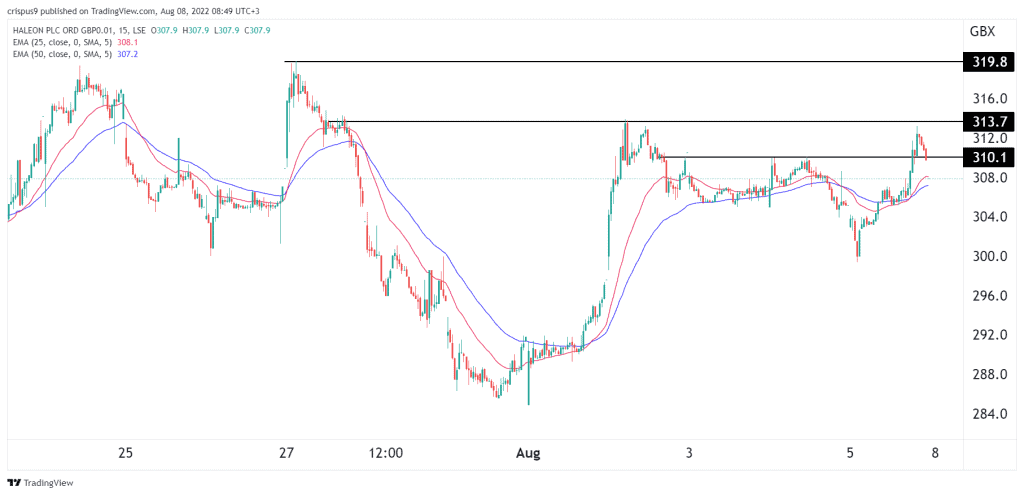

The 15-minute chart shows that the HLN share price has done well in the past few days. It rose to a high of 313.2p on Friday, which was the highest point since August this year. It has managed to move above the 25-period and 50-period moving average. The stock moved slightly below the important support at 310p, which was the highest point on August 4th.

Therefore, a bullish comeback will be confirmed if the price moves above the important resistance point at 313.7p. If this happens, the next key resistance point to watch will be at 320p. A drop below the support at 308p will invalidate the bullish view.