- The gold price was lower by around $60 into the weekend after the U.S. dollar shook off its recent weakness to stage a four-day rally.

The gold price was lower by around $60 into the weekend after the U.S. dollar shook off its recent weakness to stage a four-day rally. Strong ISM Manufacturing data started the greenback’s bounce on Wednesday and this was followed by NFP job numbers which were close to analyst expectations, but came with an unemployment rate that was 1 percentage point lower. The move higher in the dollar has dragged other commodities lower with oil back below $40 and further strength would threaten the recent bull run in gold. The precious metal is up 30% from the mid-March liquidation in markets.

Alongside the recent weakness in the U.S. dollar, gold has been rising on a fear of runaway inflation due to aggressive central bank action. Although inflation is ticking up in the world economies there is no near-term threat and this may weigh on prices with profit-taking. In the United States for example, the inflation rate is currently 1%, but this is still a long way from the 2.5% that was seen before the coronavirus outbreak.

Thursday sees the European Central Bank meeting and this could bring volatility for gold if the bank makes a statement on the Fed’s recent commitment to inflation targeting. There is no policy action expected from the bank, but a build in the Eurozone’s bond-buying program could also spur buying in gold.

Gold Price Technical Outlook

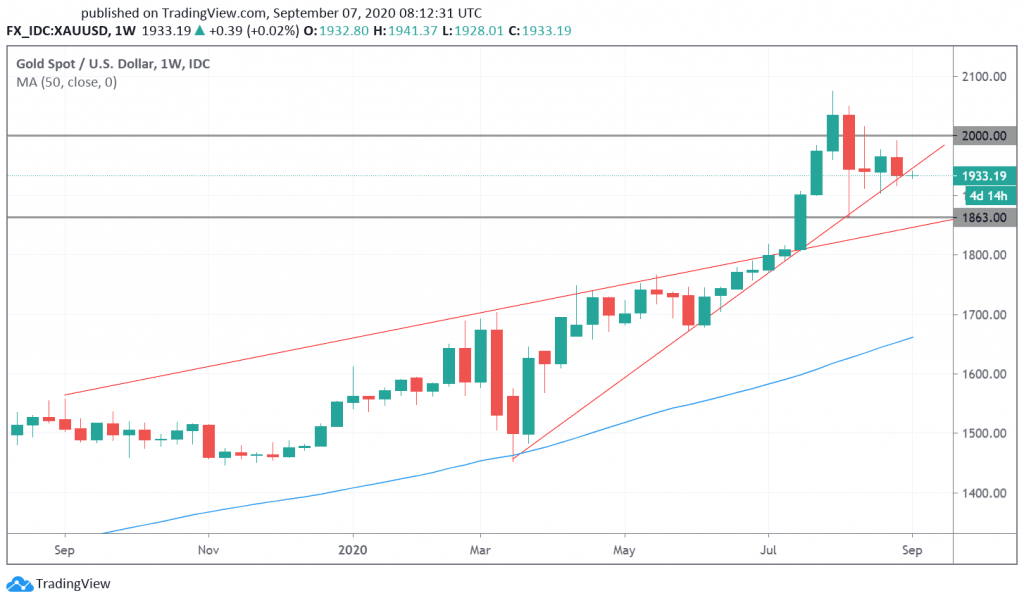

Gold’s technical outlook is currently marked by a double failure of the $2,000 level. This combined with last week’s bearish engulfing bar hints that further lows are possible. The first downside target is at $1,863, which also starting to align with the uptrend channel. A bearish move through these levels could open up a move to the $1,700 support. The $2,000 resistance would remove the bearish tone, but the current uptrend needs to hold. The Investing Cube team is available for one-to-one coaching in the markets. You can find more details here.