- On Thursday, the Gold price recovered from the post-FOMC dump, jumping over $30 from Wednesday's low, reclaiming the critical moving averages.

On Thursday, the Gold price recovered from the post-FOMC dump, jumping over $30 from Wednesday’s low, reclaiming the critical moving averages. Spot Gold (XAUUSD) is unchanged at $17.91.65 in early Asian trading Friday as traders digest this week FOMC decision.

On Wednesday, the US Central bank announced it would start to scale back its asset purchase programme. As expected, the Fed will trim its treasuries and mortgage-backed securities purchases by $15 billion per month, from $120 billion to $95b. Fed chair Jerome Powell also outlined plans to reduce bond purchases further in December: “similar reductions in the pace of net asset purchases will likely be appropriate each month”.

Whilst the ‘taper’ should be harmful to the Gold price, it was Powell’s remarks on interest rates that gave bulls a glimmer of hope, “We don’t think it’s time yet to raise interest rates. There is still ground to cover to reach maximum employment both in terms of employment and terms of participation.” As a result, Gold tried to crack $1,800 yesterday but was rejected at first touch. Nonetheless, the price is back above the long-term moving averages, which is constructive.

Price Analysis

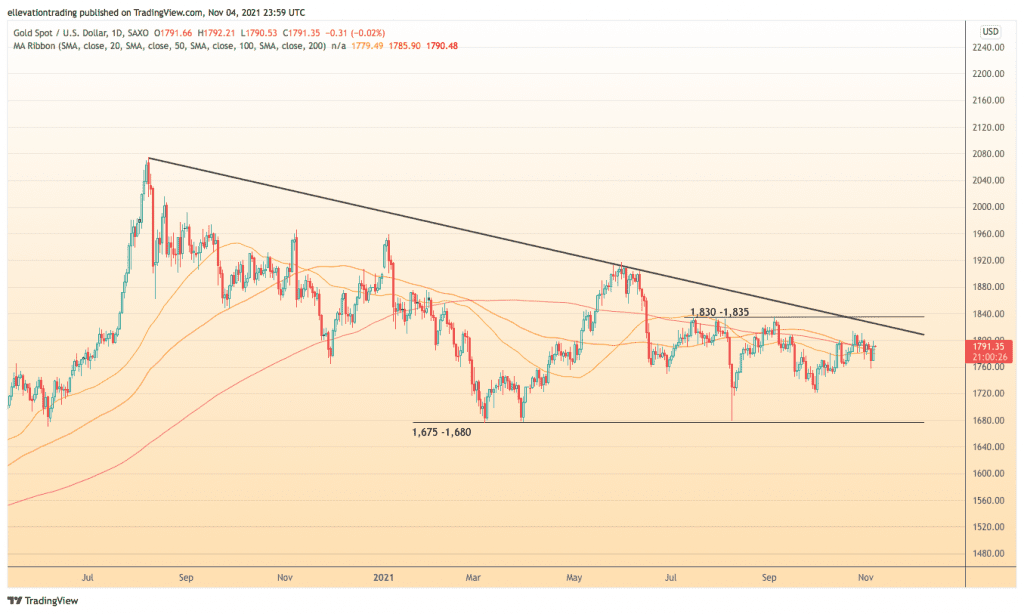

The daily chart shows Gold is trading in a long-term descending triangle pattern, which is considered bearish. However, the price is clear from the bottom end of the range at $1,675-1,680. Furthermore, yesterday’s bounce has lifted XAUUSD above the 50, 100 and 200-DMAs at $17890, $1,786 and $1,790.50. As long as Gold stays above the 200-Da, a test of trend resistance at $1,825 is possible.

However, if the price reverses below the indicators, Wednesday’s $1,760 looks likely. At the same time, a steeper decline could target the September low of around $1,722. On balance, the Gold price could go either way. A lot will depend on whether the price ends today above or below the significant moving averages. For that reason, the best plan of action is to sit tight and let today’s session play out.

Depending on today’s session, a clear-cut opportunity should emerge next week. Therefore, I am currently neutral about the price until tonight’s closing bell.

Gold Price Chart (Daily)

For more market insights, follow Elliott on Twitter.