- The spot Gold price continues to be capped by the psychological $1,800 barrier, despite sky-high inflation expectations.

The spot Gold price continues to be capped by the psychological $1,800 barrier, despite sky-high inflation expectations. After a failed attempt to clear the big figure and the long term moving averages last week, Gold (XAU/USD) has pulled back over $30 and last trading at $1,768.

The Gold price performed poorly in the third quarter, considering the widespread inflationary pressure. The belief that Gold offers an effective hedge against inflation has lost its shine recently. Over the last year, investors have shunned the yellow metal for Bitcoin, which has massively outperformed Gold in 2021. BTC is currently trading at $62,000, just off the all-time high and up 447% over the last 12 months, vs Gold’s -6.8% drop. Furthermore, the newly launched Bitcoin-based ETF will make the digital asset more accessible to the masses and could suck capital from Gold in the future. As a result, Gold lacks a bullish catalyst, and the price action suggests the path of least resistance is lower.

XAU/USD price Analysis

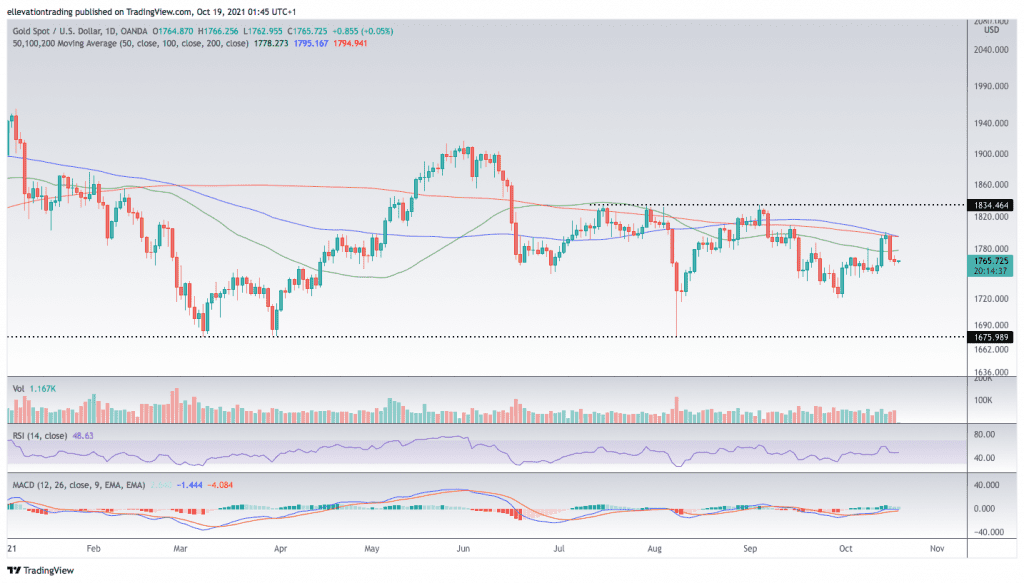

Ther Gold price performed well in the first half of this month, gaining 4% by the 14th. However, the price ran into robust resistance at the 100, and 200-day moving averages (DMA’s) at $1,798 and $1,796, respectively. As a result of failing to hurdle the indicators, Gold slid 1.6% on Friday from $1,796.50 to $1,767. Subsequently, the price is now below the 50-DMA at $1,778, reinforcing the negative momentum.

As long as Gold continues to do business below the long-term momentum indicators, I expect weakness to prevail. On that basis, I maintain a bearish view, targeting the September low of $1,720. However, if the Gold price closes above $1,800, it will invalidate the bearish thesis.

Gold Price Chart (Daily)

For more market insights, follow Elliott on Twitter.