Gold prices fell on Friday in the early London session, and the losses on the XAU/USD pair appear to have steepened after the release of the Non-Farm Payrolls.

According to the report released by the Department of Labor, the US economy shed 140K jobs in December 2020. However, the unemployment rate stayed static at 6.7%. Average Hourly Earnings climbed in December to 0.8%, which was a sharp spike from the previous month’s 0.3%.

Further information showed that there was an increase in remote working, up from 21.8% to 23.7%. 15.8 million persons reported job losses as a result of closures or loss of business; a 1.0 million order of increase from November. 4.6 million persons could not search for work as a result of lockdowns and so did not come into the labour force in December.

Gold price slumped to its lowest levels in a week, allowing the XAU/USD pair to drop by 1.55% as at the time of writing. Apparently, the markets had priced in the NFP outcome and preferred to ride the USD’s status quo ante for the last three trading sessions, as indicated in our preview article yesterday.

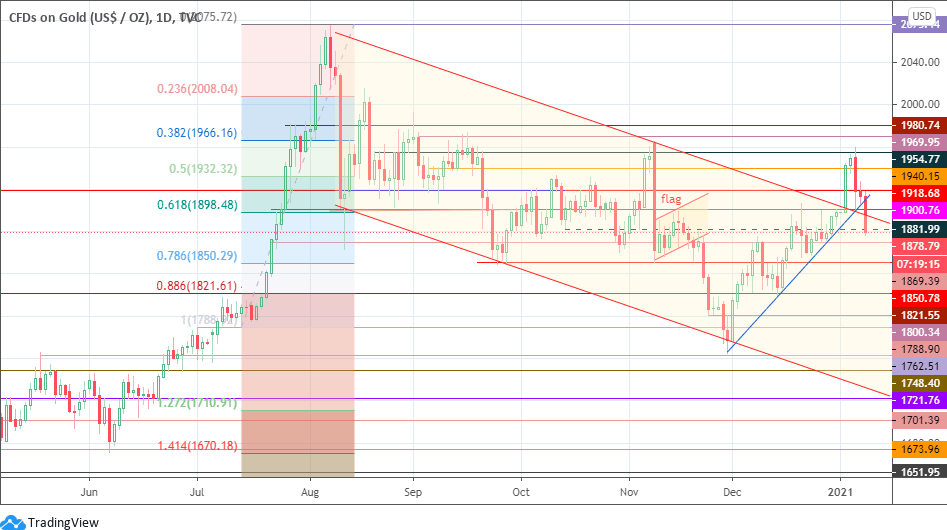

Technical Levels to Look Out For

Today’s decline has violated the ascending support trendline and is currently testing support at 1881.99. A breakdown of this area targets 1869.39, with 1850.78 lining up as additional support.

On the other hand, a bounce on the current support allows the XAU/USD pair to target 1900.76, with 1918.68 and 1940.15 serving as immediate upside targets.

Don’t miss a beat! Follow us on Telegram and Twitter.

XAU/USD Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.