- GBPUSD looks bearish here as it comes down from the highs. Looking for it to keep declining to a support area given by horizontal and dynamic levels.

The GBPUSD strength over the summer is nothing short of impressive. The pair rose to the 1.35 area, with few pullbacks after it managed to climb above the 1.30 level.

Speaking of the round number, the 1.30 is key in any possible advance that may lie ahead. Let us review the main events ahead for the GBPUSD in the months to come.

First, the USD was hit by a wave of selling after the Fed shifted its monetary policy framework to average inflation targeting. The Bank of England, although usually following close in the Fed’s footsteps, it is unlikely to deliver a similar change. Hence, the difference between the two monetary policies will have its saying in the cable’s volatility.

Second, the U.S. Presidential election is just around the corner. It is unlikely that investors will take risks ahead of it. What is likely is that investors will book some profits. As the GBPUSD rising trend started in the 1.15 area and continued unabated all the way to 1.35, investors may want to take some chips off the table.

Third, Brexit remains a wild card still. There is still much left to be done, and the December deadline comes closer with every day that passes. This week we have heard the usual complaints from both sides present at the negotiation table, and this is never a good sign in terms of measuring the progress made.

GBPUSD Technical Analysis

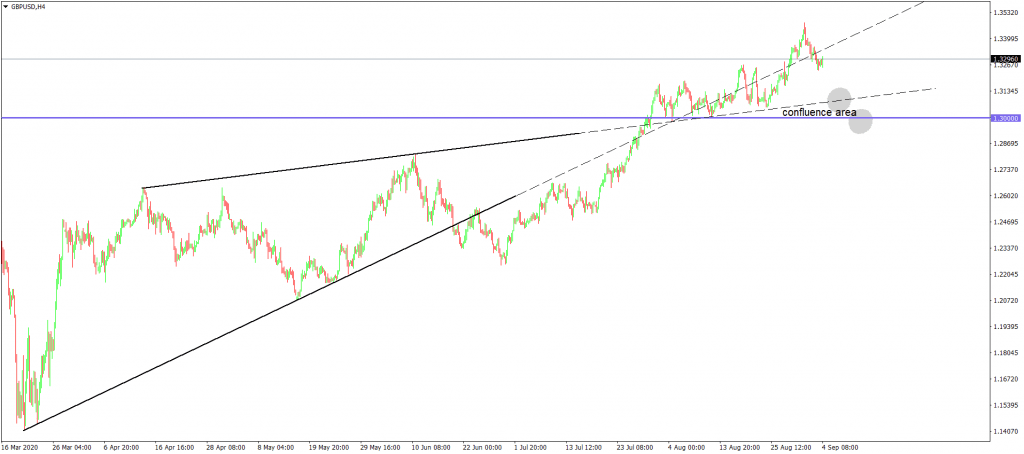

In light of everything mentioned so far, cable has room to correct to the confluence area marked by both dynamic and horizontal support.

On the one hand, dynamic support comes from the rising b-d trendline of a previous triangle that cable broke on its move higher. On the other hand, horizontal support comes from the magical 1.30 level.

Consider staying short for 1.30 with a stop-loss at the highs. While not a very appealing risk-reward ratio, being short makes sense from a fundamental point of view too.

For more about fundamental analysis, consider enrolling in our Forex trading course.