- The GBP/ZAR looks set for a correction after the BoE warns of a long recession following its 50 bps rate hike.

The GBP/ZAR is trading lower by 0.7% after the BoE rate hike decision. The pair is seeing selling pressure after the UK’s apex bank warned of a lengthy recession following its 50 bps rate hike this afternoon. The last time the bank raised interest rates by this much was in 1995. The hike represents a jump from its previous single rate-hike moves of 25bps it has carried out four times in 2022.

Despite meeting the market expectations and with the 50bps rate hike already being priced in by traders, the market focus shifted squarely to the press conference by the BoE Governor, Andrew Bailey.

The BoE has warned that the UK is facing the worst economic squeeze in the last six decades as sky-high inflation levels continue to outstrip the pace of wage growth. Wages are growing at an average of half the inflationary rate in the UK. As a result, several workers’ unions have either given notices of industrial action or embarked on strikes to press employers for more significant wage increases.

The BoE has also forecast that 2022 end-of-year inflation could hit 13%, higher than its previous forecasts. However, the bank expects this to cool off to 9.5% in 2023 as the impact of the rate hikes permeates the UK economy. The pessimistic commentary sparked a selloff on the GBP/ZAR pair.

GBP/ZAR Forecast

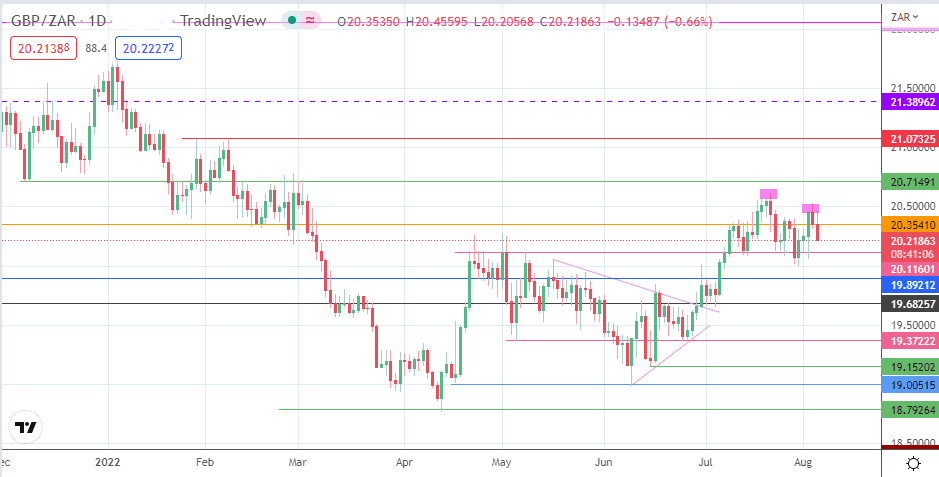

The daily chart shows progressively lower highs, which could signify that the upside move from the break of the symmetrical triangle on 30 June 2022 has stalled. The current resistance at 20.50000 (4 March and 2 August 2022 highs) is where the measured move from the triangle’s breakout will attain completion. A breakdown of the immediate support at 20.11601 (9 May high, 13 July/1 August lows) gives the bears access to the 19.89212 support. A further extension of this correction makes 19.68257 another harvest point for the bears.

Conversely, a break of the 20 July peak and the 20.71491 resistance (11 February and 2 March highs) allow the bulls to pursue additional targets to the north at 21.07325 (28 January and 8 February 2022 highs). 21.38962 forms an additional price target to the north, being the site of the 16 December and 7 January highs.

GBP/ZAR: Daily Chart