- The GBP/ZAR price crashed to the lowest point since August 17th after the latest South Africa inflation data. What next?

The GBP/ZAR price crashed to the lowest point since August 17th after the latest South Africa inflation data. The price crashed to 19.81, which was sharply lower than this week’s high of 20.20. It is also about 45 below the highest point this year, meaning that the South African rand has outperformed the British pound.

South Africa inflation data

The GBP to ZAR price continued dropping as investors focused on the important economic data from South Africa. On Wednesday, the country’s statistics agency said that South Africa’s unemployment rate dropped from 33% in Q1 to 32%. The rate remains significantly at elevated levels, meaning that the government has a lot of work to do.

The GBP/ZAR price sell-off continued after South Africa’s consumer and producer price index data. On Wednesday, data showed that the country’s consumer price index rose to 7.8% in July from 7.4% in the previous month. The core CPI, which excludes the volatile food and energy, rose to 4.6%, which was the highest level in decades.

Additional data showed that the producer price index rose to 18%, which was better than the median estimate of 17.6%. It rose by 2.2% on a month-on-month basis. Therefore, the pair dropped sharply as investors expect that the South Africa Reserve Bank (SARB) will continue hiking interest rates.

Meanwhile, there are concerns about the UK economy as inflation soars. Analysts at Citigroup expects that inflation will soar to 18.3% in January next year. The Bank of England expects that inflation will hit 13% while Goldman Sachs believes that prices will rise to 15%.

GBP/ZAR price forecast

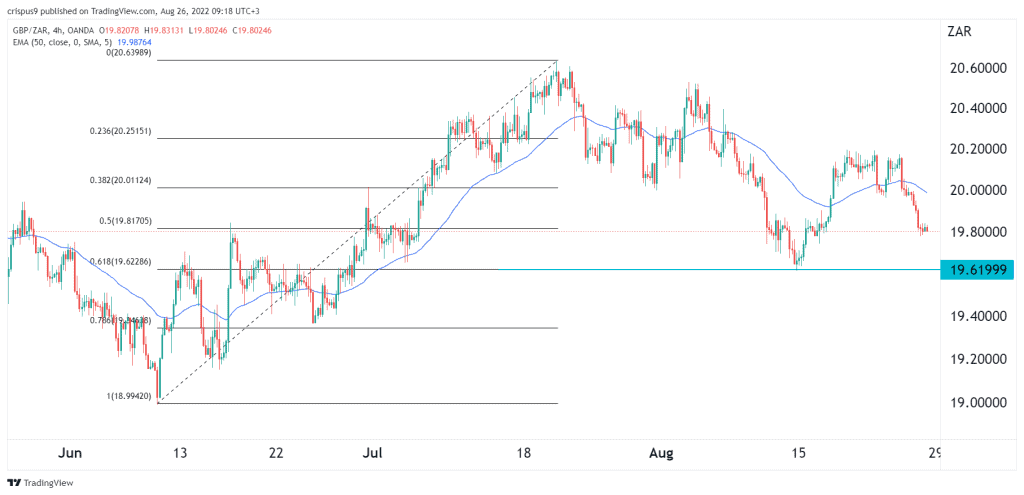

The four-hour chart shows that the GBP to ZAR price continued falling this week. The decline happened after the pair formed a double-top pattern. It moved below the neckline of the pattern at 20. The pair moved below the 25-day and 50-day moving averages and the 50% retracement level.

Therefore, the pair will likely continue falling as sellers target the next key support level at 19.62. A move above the resistance at 19.90 will invalidate the bearish view.