The GBP/USD is under pressure today as investors digest the happenings in the United States and the recently-announced lockdowns in the UK. The GBPUSD is trading at 1.3587, which is slightly below yesterday’s high of 1.3665.

What happened: A few things happened overnight. First, Jon Ossof managed to defeat David Perdue in Georgia, making Chuck Schumer the next Senate majority leader. While this means higher taxes and regulations, it also means more stimulus in the near term. This will be positive for the GBP/USD.

Second, the monthly ADP report was a disaster. The company said that the American economy lost more than 123,000 private-sector jobs. This will provide more incentives for Congress to enact stimulus. Finally, the Senate confirmed Biden as the next president, in a night of chaos in Washington.

Looking ahead: Later today, there will be no economic data from the United Kingdom. Still, the GBP to USD pair will react to the initial jobless claims from the United States. These numbers will come a day ahead of the official nonfarm payroll data from the country. The GBP/USD will also react to the export and import data from the country.

GBP/USD technical analysis

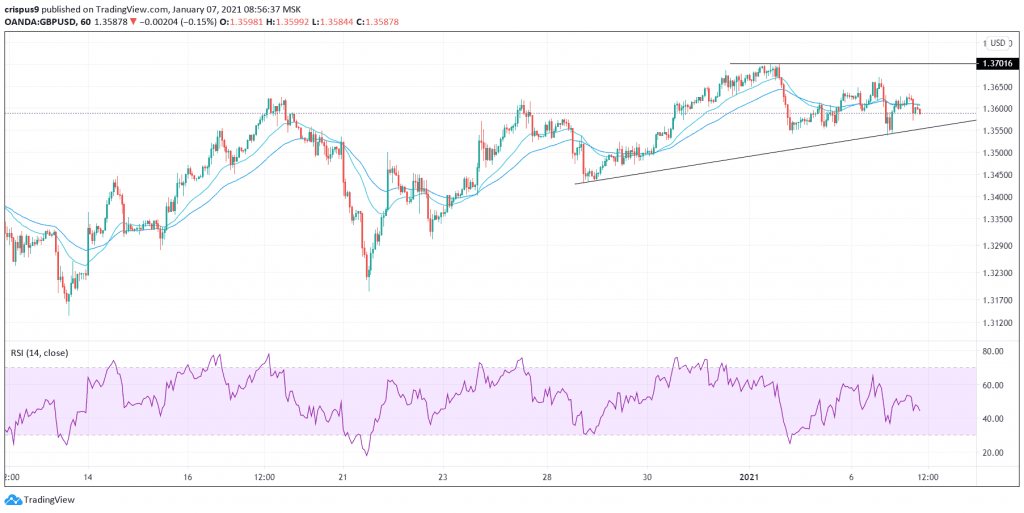

On the hourly chart, we see that the GBP to USD pair has been under pressure. It is trading at the 25-day and 15-day EMAs. It has also formed an ascending triangle pattern that is shown in black. Therefore, the pair will possibly decline today as investors eye the lower side of the triangle at 1.3557. However, in the near term, the bullish trend will remain since momentum is against the USD.

Don’t miss a beat! Follow us on Telegram and Twitter.

GBP to USD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.