The GBP/USD pair is trading higher for the 6th straight day as the weakness on the US Dollar continues.

The weakness seen in the greenback stems from the “lower for longer” stance the Fed seems to have adopted regarding US interest rates, which has taken the sting of early hawkish bets. This has allowed the GBP/USD to gain massive traction this Monday, hitting 1-month highs with a gain of 0.74% and counting.

There is no major economic news data out of the US for the entire week. Price action on the GBP/USD pair will therefore be subject to the sort of technical plays that we see on the daily chart.

Technical Outlook for GBP/USD

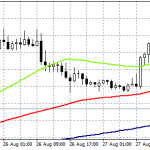

The GBP/USD daily chart shows that the pair has violated the consolidation flag area’s upper border and is targeting the 1.4002 psychological resistance. For this to happen, the break above this border and the 1.38927 price level must be confirmed. Above 1.4002, we have additional upside targets at 1.40986 and 1.41770. The January/April 2018 double top remains the price projection from the pole of the flag if the 1.3200 low on 21 December 2020 is regarded as the pattern’s commencement point.

On the flip side, we would only see a decline if the breakout move is not confirmed, and the price closes below the 1.38520 support. This would allow for a decline that uses the flag’s upper edge as the key resistance, with the move targeting 1.37998. 1.37557 and 1.36703 in sequence, as price aims for the flag’s lower border. Only a decline below 1.3500 invalidates the flag and opens the door for a downward reversal of the trend.