- RBI and BoE interest rate decisions are at the core of the GBP to INR forecast. UK GDP preliminary data is also due in the week.

The GBP/INR price has been in a bearish trend in 2022 as the divergence between the UK and the Indian economies continued. While India has emerged as the fastest-growing major economy in the world, the UK economy has been in turmoil. In October, the GBP to INR price has crashed by more than 7% and is trading at 92.67. With this in mind, this article will focus on GBP to INR forecast for the period between 2022 and 2025.

Table of contents

GBP to INR price history

Between 1998 and 2002, GBPINR was largely trading within a range of between 64.10 and 72.35 rupees. Subsequently, it rallied to a high of 89.60 rupees in late 2006 before returning to the aforementioned range in 2010.

Between April 2010 and August 2013 was characterized by a steady uptrend that saw the exotic pair hit an all-time high of 106.96 rupees. This was followed by downward pressure to a five-year low of 79.53 rupees as of April 2017.

With the subsequent rallying, GBPINR has been holding steady above 80 for five years. Indeed, the psychological level of 100 has offered steady support to the currency pair since the beginning of 2021. At its current level of 101.98, it is 3.66% below the 6-year high it hit in April 2021 at 105.25 rupees.

GBPINR has been holding steady above 80 for five years with the subsequent rallying. Indeed, the psychological level of 100 has offered steady support to the currency pair since the beginning of 2021. However, at its current level of 101.40, it is 3.12% below the 6-year high it hit in April 2021 at 105.25 rupees.

GBPINR latest news

There have been several important GBP/INR news in the past few weeks. First, Lizz Truss decided to replace Kwasi Kwarteng as Chancellor after his rollout of major debt-funded tax cuts. She replaced him with Jeremy Hunt, who has vowed to reduce government spending while raising some taxes. This is a major reversal from what the new government envisioned.

Second, data published recently showed that UK’s inflation continued rising in the past few months. The headline CPI rose to 10% in September, which was a slight increase from the previous month’s 9.5%. This inflation figure has been offset by the overall government intervention. Without them, analysts believe that the company’s inflation would end the year at about 18%.

The Bank of England (BoE) has maintained a hawkish tone in a bid to fight soaring inflation. Analysts expect that the bank will hike interest rates by a giant 100 basis points soon.

Third, the other GBP/INR news is that Indian central bank has committed to lower inflation. Analysts believe that India’s inflation is still manageable since it is slightly above its historical range.

When will GBP to INR increase?

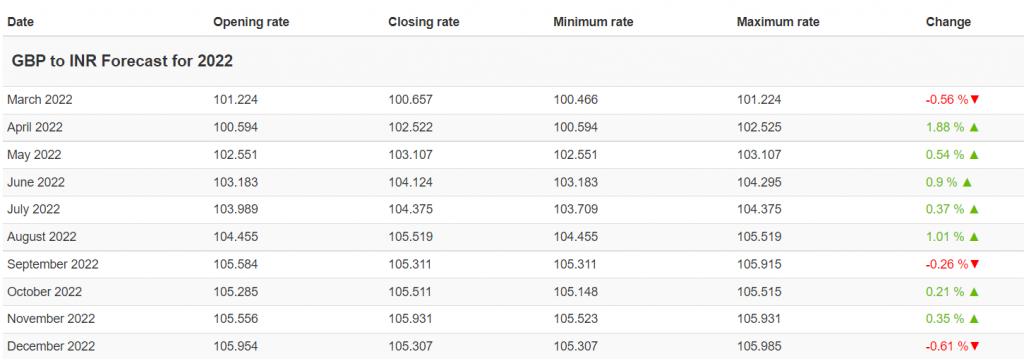

Wallet Investor’s GBP to INR forecast 2022 is rather bullish. According to the firm, the exotic currency pair will be at 104.29 rupees by mid-year. It will likely rally further to 105.98 rupees by the end of 2022.

GBP to INR forecast 2022

GBP to INR forecast 2022 is founded on the BoE and RBI’s monetary policies, and the overall health of both economies. On the one hand, RBI will likely turn less dovish in coming months as part of its efforts to deal with inflationary pressures. Such a situation would curb GBPINR upward potential. At the same time, the aggressive tightening of BoE’s monetary policy is expected to boost the currency pair.

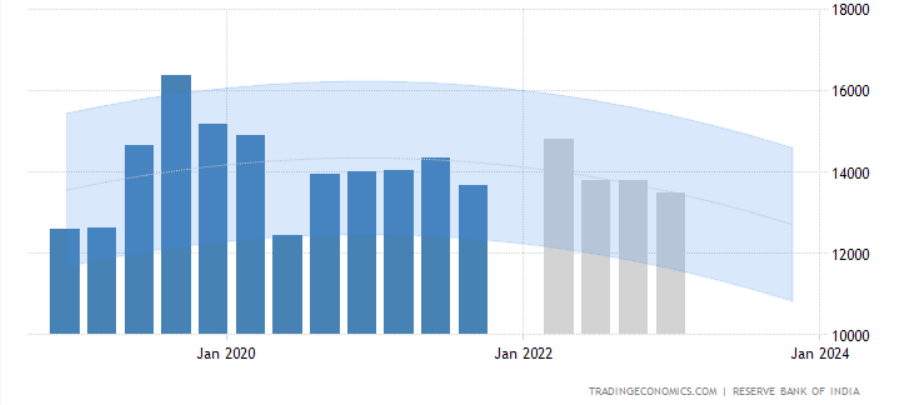

India remittances

Besides, as the leading recipient of remittances worldwide, investors will also be keen on the flow of funds into the country in coming months. According to Trading Economics, remittances in the Asian country will likely increase to $14.8 billion in the end of the current quarter.

In the past year, it dropped from $14.35 billion in the second quarter to $13.66 billion in the third quarter. A rise in remittances is likely to strengthen the Indian rupee; easing GBPINR rallying.

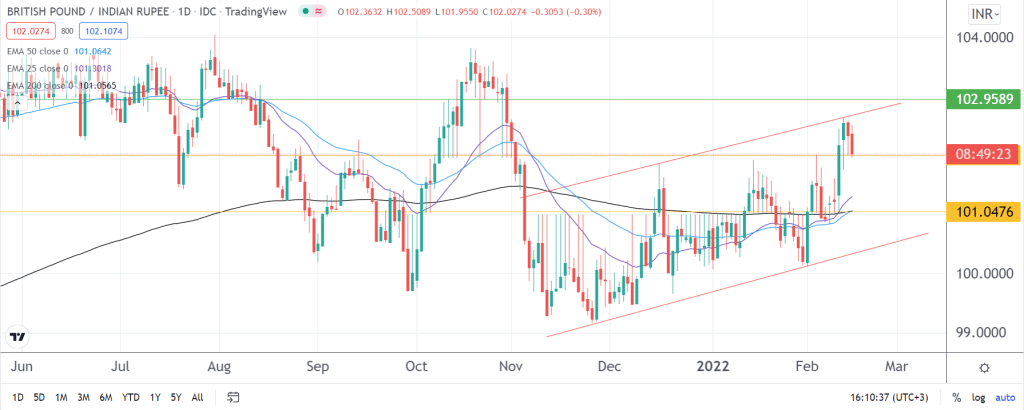

GBPINR technical analysis

On a daily chart, GBPINR is trading above the 25 and 50-day exponential moving averages. It is also trading above the long-term 200-day EMA. At the same time, the formation of an ascending channel points to further gains in the ensuing sessions.

In the immediate term, GBP to INR forecast is for the pair to find resistance at 102.00. Subsequently, it may remain within a range with 101.04 as the horizontal channel’s lower border. Notably, the aforementioned support level is at the point of convergence for the 50 and 200-day EMAs.

If the 50-day EMA crosses over the 200-day EMA to the upside(golden cross), the bulls will likely have an opportunity to raise the price further to 102.95. On the flip side, a death cross, where the 50-day EMA crosses over the 200-day EMA to the downside (death cross), GBPINR may decline further towards the range’s lower border. Below the range’s lower border, 100.70 will be a level worth looking out for.

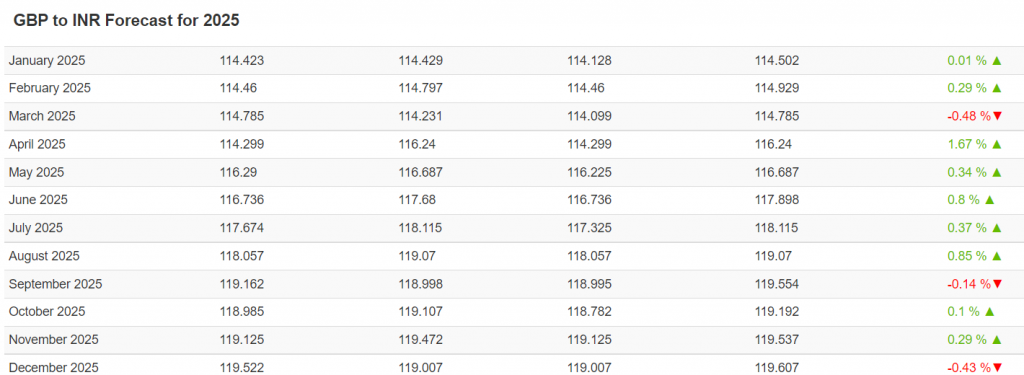

GBP to INR forecast 2025

Wallet Investor’s GBP to INR forecast 2025 is bullish. According to the firm, the exotic currency pair will hit a new record high of 114.50 rupees as at the beginning of 2025. It will rally further to 117.89 by June and reach 119.60 by the end of the year.

Nonetheless, it is important to incorporate further research rather than trading solely based on analysts’ predictions. Indeed, one of the principles of successful trading is to stick to the adopted trading strategies regardless of how tempting the forecast is.

In the medium and long-term, the economic health of India and the UK, coupled with geopolitics and monetary policies, will continue to shape GBP to INR forecast 2025.