- EURUSD looks bearish ahead of the ECB as it forms a head and shoulders pattern that points to a move to the 1.16. Here is a trading plan.

The EURUSD pair drove the entire price action on the currency market this summer. As the central banks around the world raced to cut the rates to the zero boundary and deliver further stimulus, the ECB lagged.

When compared with the Fed and the U.S. Congress in the United States, the ECB and the European Commission delivered mostly promises so far. While the ECB did ease conditions, it did not match the Fed’s easing. Moreover, the fiscal stimulus in the United States dwarfs the one in Europe.

Also, when the European Commission announced that it plans to borrow from international financial markets, it was just a plan. The borrowing starts only in September, while the U.S. already delivered its first round of stimulus.

As a consequence, the financial conditions throughout the summer eased both in the United States and Europe, but at a faster pace in America. Hence, the EURUSD exchange rate expressed that difference by trading over a thousand pips higher since last March.

ECB Meeting to Create Volatility

Now that the EURUSD pair reached 1.20, it triggered verbal intervention from the ECB. Moreover, the exceptionally low core inflation puts pressure on the ECB to act.

Remember that any action taken by the central bank needs time for its effects to be seen in the economy. Thus, if the ECB acts now, the effects will be seen in time. Or, if the ECB does not act now, it risks seeing inflation falling below the zero level.

The ECB will not tolerate such a thing.

EURUSD Technical Analysis

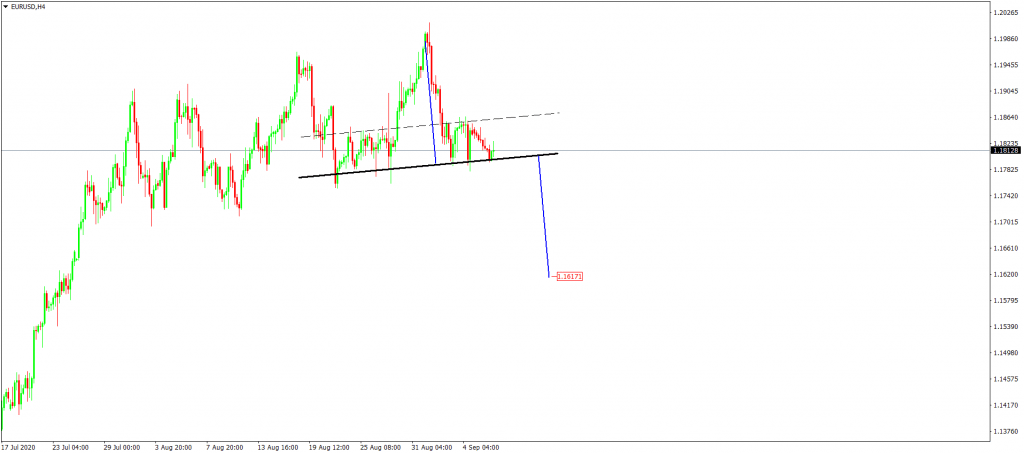

The EURUSD keeps forming higher highs, albeit only marginal ones. The recent attempt at the 1.20 level looks to be the head of a head and shoulders pattern that should mark a marginal top.

Bears want to see a break of the neckline before going short – 1.1780 will do the trick. Then, with a stop at 1.1860, they may target a move into the 1.16 area.

To learn more about technical analysis concepts, consider enrolling in one of our trading coaching programs.