HEG Ltd (NSE: HEG) saw some selling pressure today, closing at ₹541.80 after touching an intraday high of ₹563. The dip comes as investors lock in short-term gains while keeping one eye on the company’s upcoming earnings release scheduled for July 30.

The upcoming earnings report is drawing fresh attention from investors hoping for a turnaround. HEG posted a ₹63 crore loss in the March quarter, a rare setback for a company that has long been viewed as a solid performer in the graphite electrode space.

Adding to the sentiment is the board’s recent recommendation of a ₹1.80 per share final dividend, small but notable in a quarter marked by red ink. While the payout offers short-term reassurance, the focus remains firmly on earnings. A profit beat could reset the tone for the months ahead and breathe life into the stock’s next move.

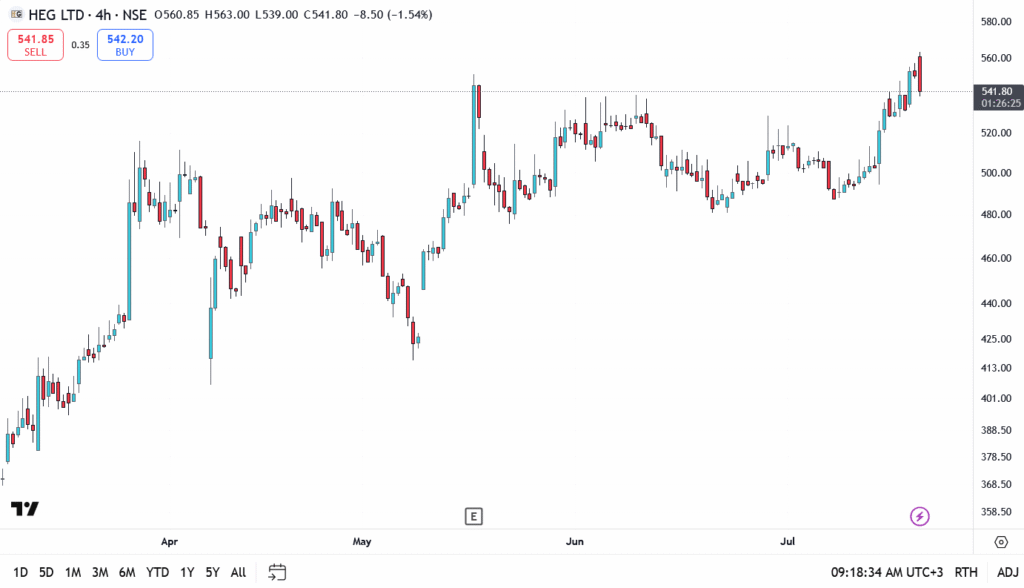

HEG Share Price

- Live price: ₹541.80

- Resistance zone: ₹560 (tested), then ₹575–₹580

- Support levels: ₹520 holds short-term structure, deeper base at ₹500

- Trend: Bullish bias intact above ₹520

- Structure: Series of higher lows since early July suggests underlying strength

Conclusion

The reaction to HEG’s July 30 earnings will likely set the tone for the stock’s next leg. A return to profitability, after last quarter’s miss, could give it enough fuel to break through the ₹560 ceiling and stretch toward ₹580. On the other hand, any sign of margin pressure or weak revenue traction may trigger another round of consolidation.

With expectations rising quietly across trading desks and forums, HEG’s performance next week may offer more than just numbers, it might redefine its near-term share price target.