- Crude oil price activity is muted today, with prices of Brent crude only trading a tad higher after positive economic data from China.

Crude oil prices are slightly higher in muted Friday trading on the back of several positive data from China. Data for industrial production, (6.9% annualized vs market consensus of 5.9%) and retail sales (8.0% annualized versus consensus of 7.9%) all surprised to the upside. GDP data was also a tad higher at 6.1% on an annualized basis, which was slightly higher than the market expectation of 6.0%.

These all added to the cautious optimism stemming from the US-China phase 1 trade deal signing and allowed prices of Brent crude to trade mildly higher. Brent crude presently trading at 64.72.

Read our Best Trading Ideas for 2020.

Technical Outlook for Brent Crude

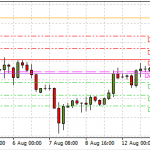

After failing to register significant movement following the US Crude Oil Inventories report, Brent crude was able to find support at the 63.71 price level. It is now turning upwards in pullback fashion. This pullback move may allow Brent crude to test the broken lower border of the channel. The channel trendline will usually act in reversed roles following a break.

However, if the dip out of the channel was a stop hunt, price activity may continue into the channel, which presents an opportunity to retest the 66.98 resistance line. If crude oil price breaks above this price level to the upside, it can then target 68.79 and 70.85 on its way to the channel’s return line.

If the pullback is unsuccessful and Brent crude resumes its downward push, it would have to breach the 63.71 support to the downside, which opens the door for the asset to target 60.66 (previous double bottom of July 2019).