The Cineworld share price crashed on Friday as risks of the new Covid-19 variant accelerated. The CINE stock price crashed to a low of 48.58p, which was the lowest level since November last year. It has crashed by more than 60% from its highest level this year.

Things have turned worse for Cineworld and other movie theatre and hospitality companies. The new Omicron variant means that some of the progress the company has done in the past few months will be undone. This will happen as more countries are set to announce new restrictions on non-essential activities.

Other risks are that many people in the UK and its other key markets will avoid going to movie theatres because of the fears of the variant. Another major risk is that major movie companies like Disney will postpone their new titles. This is a major thing since it will happen at a time when theatres tend to witness heavy traffic.

The new variant came a few weeks after Cineworld announced that it had returned to growth helped by new movie titles like No Time to Die, Dune, and Venom.

Cineworld share price forecast

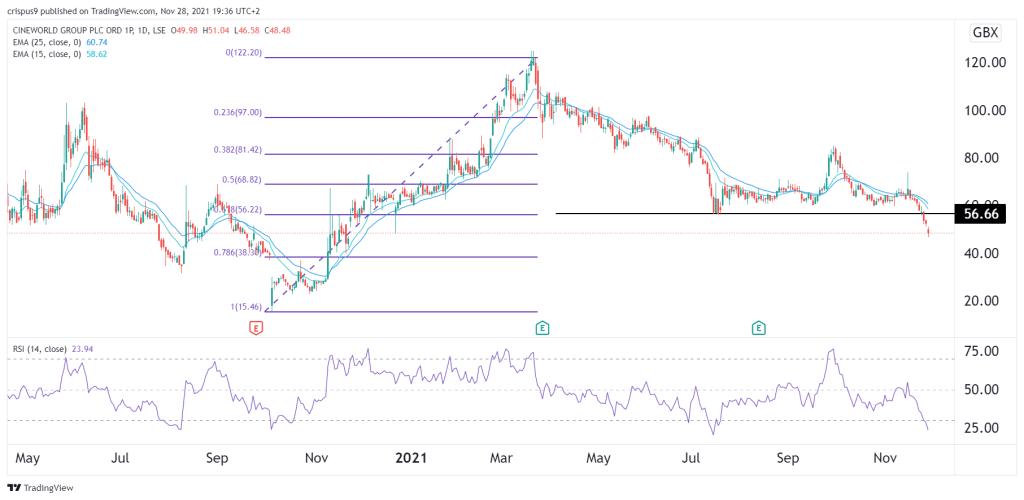

The daily chart shows that the Cineworld stock price has been in a major sell-off lately. The stock declined to the lowest level in more than a year as concerns of new lockdowns rose. It has managed to move below the key support level at 56.66p, which was the lowest level on 16th July. The shares have also crashed below the 25-day and 50-day moving averages.

Therefore, for now, the path of the least resistance for the CINE share price is to the downside. This could see the index drop to a the 78.6% retracement level at 38p. This view will be invalidated if it rises above 65p.