The ChainLink price has halved in the last month and is down over 65% from its all-time high. So just how much worse can it get?

ChainLink(LINK) is lower at $18.67 (-4.5%) on Monday, reversing the 40% bounce from the recent low. LINK has pared the rebound to 23% at the current price and appears on track to revisit Saturday’s $14.78 five-month bottom. LINK’s poor performance has seen almost $9 billion wiped from its market cap since the start of November. The network’s current valuation of $8.5 billion has forced it out of the top-20 list to rank #21 behind Uniswap.

Whilst Bitcoin’s collapse to $42k must take some of the credit for the recent weakness, ChainLink has underperformed for months. As a result, the LINK token was already breaking down long before BTC crashed below $50k. Furthermore, Bitcoin is back on the slide and down 3% so far today, erasing yesterday’s marginal gains, which suggests overhanging selling. So what does it mean for the ChainLink price?

LINK Price Forecast

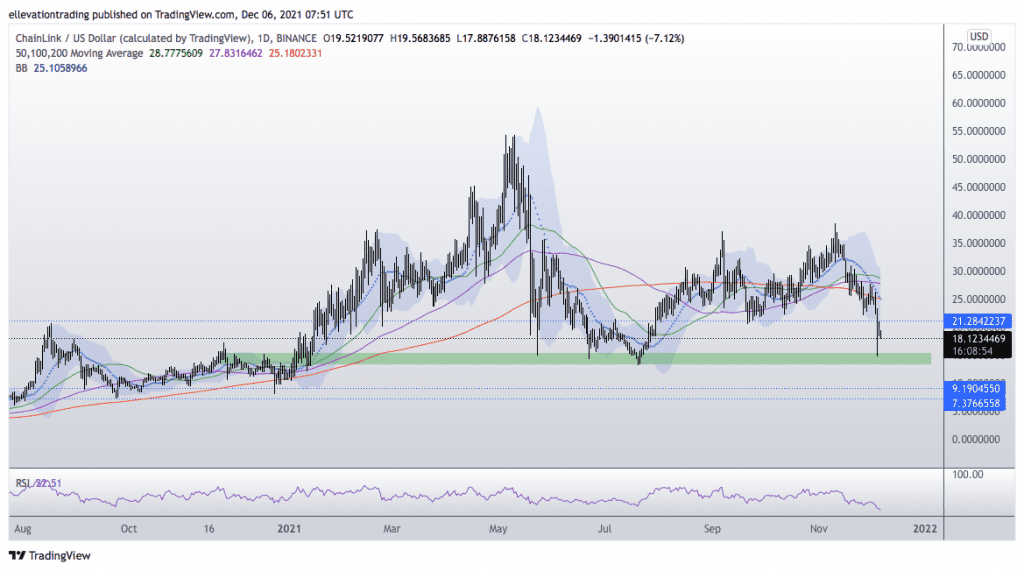

The daily chart shows LINK bounced from the $14.80-$15.50 support band. However, the rally is rolling over this morning, which I expect to continue.

The initial support is the July 20th low of $14.80. In contrast, if selling accelerates, ChainLink could overshoot to $8.00 (Dec 2020 low). Whilst the chances of the uber-bearish scenario are slim, technically, it is possible, so worth considering.

In my opinion, the outlook for LINK only improves if the price climbs above the 200-Day Moving Average at $25.18. The bearish view flips to neutral in that event, invalidating the pessimistic view.

ChainLink Price Chart (Daily)

For more market insights, follow Elliott on Twitter.