The Cardano price jumped to $2.400 on Tuesday before sliding 7.50% on Wednesday, following Bitcoin’s sharp reversal. This morning, Cardano (ADA) is unchanged at $2.079, as the market takes stock of the recent price action.

Although Cardano has underperformed, the price is up around 5.60% so far in October. However, Solana (SOL) has overtaken Cardano, leaving ADA the 6th-largest cryptocurrency ahead of Ripple (XRP). Furthermore, ADA’s lack of progress comes as the combined value of the crypto market is worth around $2.85 trillion, just short of last week’s record $3 Trillion peak.

The ADA token started this week firmly in bull mode, breaking above a descending trend-line and clearing several resistance levels. However, the rally faltered when Bitcoin suddenly dropped 9% from its $69k all-time high. As a result, Cardano slipped 20% from its intraday high before bouncing from $1.920 and closing the day back above the trend support. Subsequently, ADA has got a fight on its hands to maintain the breakout, which could be pivotal for the price.

ADA Price Analysis

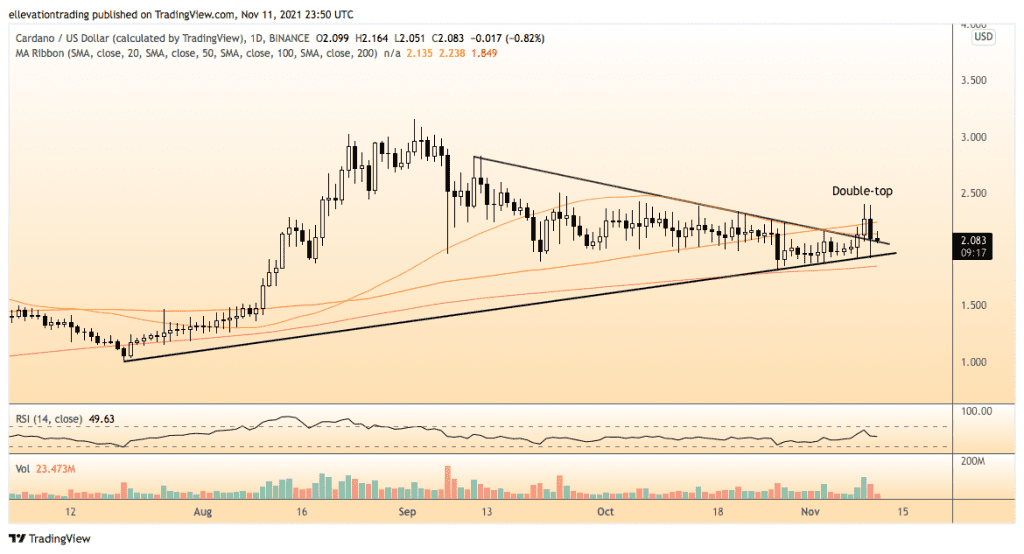

Cardano is currently trading above the trend support at $2.040 but below the 50-Day Moving Average (DMA) at $21.30 and the 100 at $2.245. Successful clearance of the 100-DMA should lead to an extension towards the September all-time high of $3.160.

The biggest threat for the bulls is if Cardano loses trend support. In that event, a rising trend-line at $1.930 and the 200-DMA at $1.853 are critical support levels. I would consider a close below the 200-DMA as extremely bearish, potentially forcing liquidation and a trip towards $1.5000. At the same time, a steeper sell-off would target the July lows around $1.000.

Cardano Price Chart (Daily)

For more market insights, follow Elliott on Twitter.