- The Hang Seng index is hanging on after Xiaomi stock falls. The DAX index, FTSE 100, CAC 40, and the Dow Jones also dropped

The Hang Seng index is pointing lower as investors react to the latest acts by Donald Trump to target some of its constituents. The index is trading at $28,470, which is close to the highest point in January last year. Similarly, in Asia, the Nikkei 225 is down by 0.65% as investors react to the latest restrictions by the Japanese government.

What happened: Donald Trump has been relatively hostile to China in the past few months. He has blamed the country for causing the coronavirus illness, thus costing him the presidency. In his latest action, the president added Xiaomi to the military blacklist that also includes other Chinese companies.

In response to the announcement, Xiaomi share price dropped by more than 12% becoming the worst performer in the Hang Seng. This is despite the fact that the company does not do any substantial business in the United States. But it uses important parts from the country, which could have significant implications.

Other laggards in the Hang Seng index include Geely Automobile, AAC Technologies, Sands China, and Meituang Dianping. On the other hand, the best performers in the index are Wharf Real Estate, AIA Group, Alibaba, ICBC, and Ping An Insurance.

Elsewhere: Other global stocks are falling as investors react to the stimulus speech by Joe Biden. In the United States, indices tied to the Dow Jones, S&P 500, and Nasdaq 100 index have declined. Similarly, in Europe, the DAX index, FTSE 100, and CAC 40 futures are pointing lower because the stimulus price tag was smaller than expected.

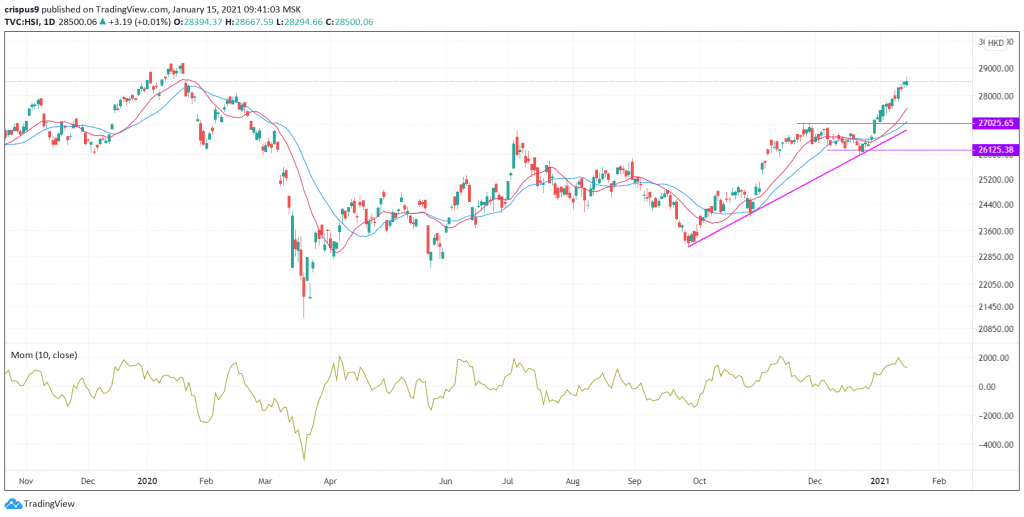

Hang Seng technical outlook

The Hang Seng index has been on a strong upward trend in the past few months. It has jumped by more than 35% from the lowest point last year.

Today, it remains above the 50-day and 100-day moving averages while the momentum indicator has remained above the neutral level of 0. Therefore, the index will possibly continue rising as bulls target the next resistance level at h$29,000.