The FTSE 100 index is set to open higher as several mining giants publish their trading updates. It is also rising as the US earnings season goes on and as traders wait for more stimulus from the United States. It is trading at £6,733, which is slightly above this week’s low of £6,700.

What’s happening: There are three main reasons why the FTSE 100 index is rising. First, several of the biggest mining companies in the index will publish their earnings. These include giants like Rio Tinto, Antofagasta, and BHP Group. Other non-mining companies that will publish today are Burberry, CMC Markets, JD Weatherspoon, and WH Smith.

Second, the FTSE 100 is rising because of the impressive earnings from American companies like Goldman Sachs, JP Morgan, and Bank of America. Netflix also reported better results as its members soared to more than 200 million. Therefore, FTSE 100 banks like Barclays, Lloyds Bank, and NatWest will be in the spotlight following the strength of the American counterparts.

Finally, the index is rising ahead of Biden’s inauguration since investors expect more stimulus from the American government. Meanwhile, the spotlight will be on Entain, the bookmaker whose shares fell by more than 15% yesterday. This happened after MGM decided to abandon its takeover offer. The stock could rise today if there’s speculation of a bid from another company.

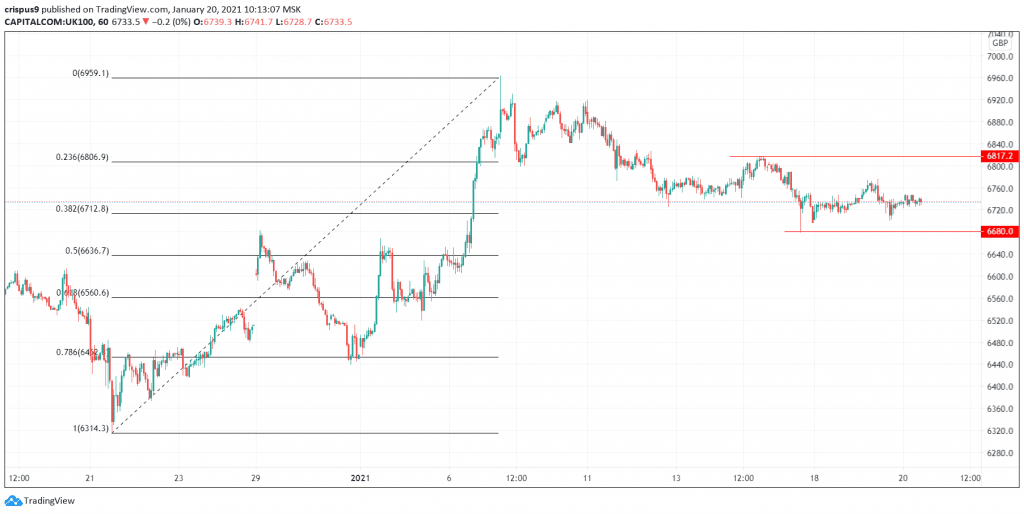

FTSE 100 technical analysis

The FTSE 100 index is moving sideways in the past few days. It is between the important support and resistance levels at £6680 and £6817. It is also slightly above the 38.2% Fibonacci retracement level. Therefore, for today, I suspect that the index will remain in the current range ahead of a breakout in the near term.

Don’t miss a beat! Follow us on Telegram and Twitter.

FTSE index technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.