The FTSE 100 index is wavering ahead of key earnings reports this week. The Footsie is trading at £6,715, which is slightly above last week’s low of £6,677. Other major global indices like the CAC 40, Dow Jones, and Nasdaq 100 are mixed, with US stocks rising ahead of Joe Biden’s inauguration.

Key earnings ahead: FTSE 100 investors will be focusing on several key earnings and trading updates from constituent companies. Tomorrow, companies like Rio Tinto, BHP Group, and Antofagasta will release their earnings. Other companies to watch will be JD Weatherspoon and WH Smith.

In general, because of the strong commodity prices, analysts believe that companies like Rio Tinto, Antofagasta, and BHP Group will publish strong results. Also, Burberry will possibly report strong holiday sales, boosted by the Asian business. JD Weatherspoon, the pub operator, will possibly issue a warning due to the ongoing lockdown in the UK.

MGM walks away: The biggest mover in the FTSE 100 index today was Entain, formerly know as GVC Group. The company’s shares dropped by more than 16% after MGM abandoned its acquisition plan. The company had until February 1 to make a formal offer for Entain. It said:

“After careful consideration and having reflected on the limited recent engagement between the respective companies regarding MGM’s rejected all stock proposal . . . does not intend to submit a revised proposal,”

Entain owns several popular sports betting companies like Bwin, Ladbroke, Coral, and Betdaq. It also owns several game brands like PartyCasino, Gala Bingo, and Gala Spins, among others.

FTSE 100 technical outlook

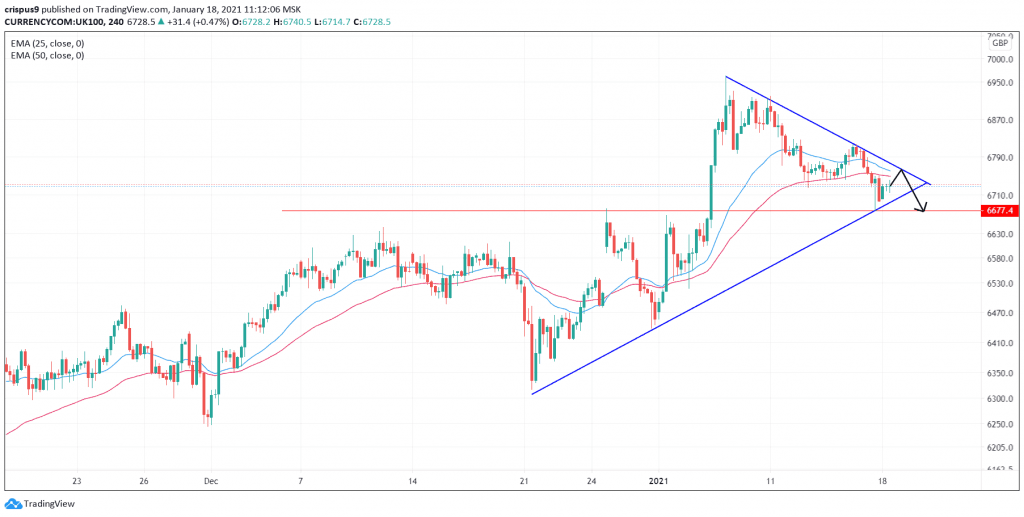

The FTSE 100 index has been under pressure in the past few days. It has moved from the year-to-date high of £6,960 to the current £6,736. On the four-hour chart, the index has moved slightly below the 25-period and 15-period exponential moving averages (EMA). It has also formed a triangle pattern that is nearing its convergence point.

Therefore, in the near term, the index will likely rise to the upper side of the triangle and then resume the overall bearish trend. If this happens, the next level to watch is the support at £6,677. However, a move above £6,790 will invalidate this trend.

Don’t miss a beat! Follow us on Telegram and Twitter.

FTSE 100 technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.