- Supply chain issues pose a challenge for the Boeing stock price, but a new order for the 737 MAX could limit the downside move.

The Boeing share price is trading lower this Thursday as investors’ concerns over the impact of supply chain challenges on the company’s operations proved to be the overriding trigger for price action.

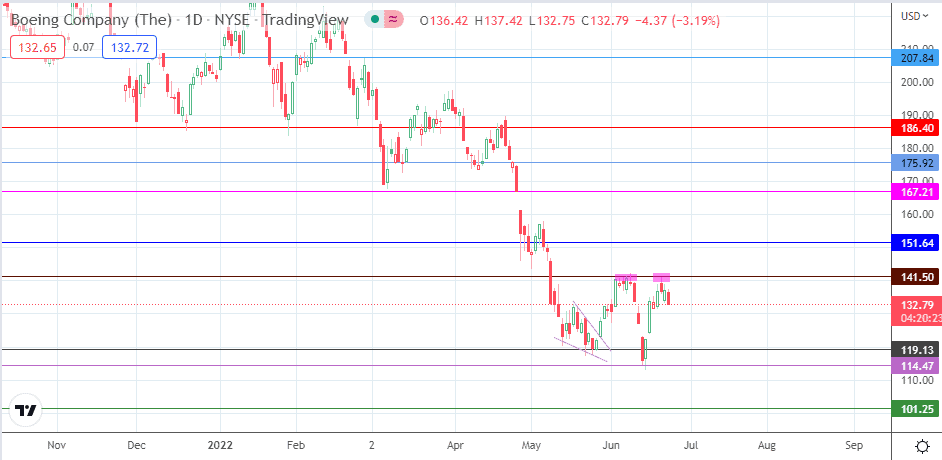

Following the 0.04% decline off the rejection at 141.50, the uptick of Wednesday failed to dent a significant portion of this drop. This paved the way for further weakening of the Boeing stock price, which is 2.06% lower as of writing.

Boeing’s Chief Executive David Calhoun was at Bloomberg’s Qatar Economic Forum. He indicated that the smaller and mid-tier suppliers would continue to struggle with labour shortages, which could impact the supply chain and lead to production impairments. Calhoun blamed the situation on the continued impact of COVID-19.

However, the Boeing stock price may also see its downside move limited as news of a 50-aircraft purchase by Norwegian Air Shuttle hit the airwaves. An online report indicates that the air carrier is to settle all legal disagreements with Boeing, culminating in purchasing 50 737 MAX 8 aircraft, with an option to purchase another 30. This could be good news for the company, which is trying to push through outstanding recertification of this aircraft model following modifications made after two fatal air crashes.

Boeing Stock Price Forecast

The rejection at the 141.50 resistance on 21 June has set the pace for the decline. However, the bears need to push the stock below the $130 psychological support to gain access to the support level at 119.13 (25 May 2022 low). A breakdown of this level brings in 114.47 (13 June low) into the mix.

This price mark serves as the neckline that must be broken before the double top of 7 June and 21 June is considered complete. A breakdown of this level completes the pattern and brings in 101.25 (17 March 2020 low) and 90.40 as potential harvest points for the bears. The latter will serve as the measured move’s completion point in this instance.

On the flip side, a break of 141.50 to the upside nullifies any attempt at price action forming a double top. Instead, this scenario will favour an advance that makes 151.64 (6 May high) the bull’s next target. Additional targets to the north are seen at 167.21 (26 April low) and 175.92, the site of the 25 April high. Attainment of the 167.21 resistance covers the gap of 27 April 2022.

Boeing: Daily Chart