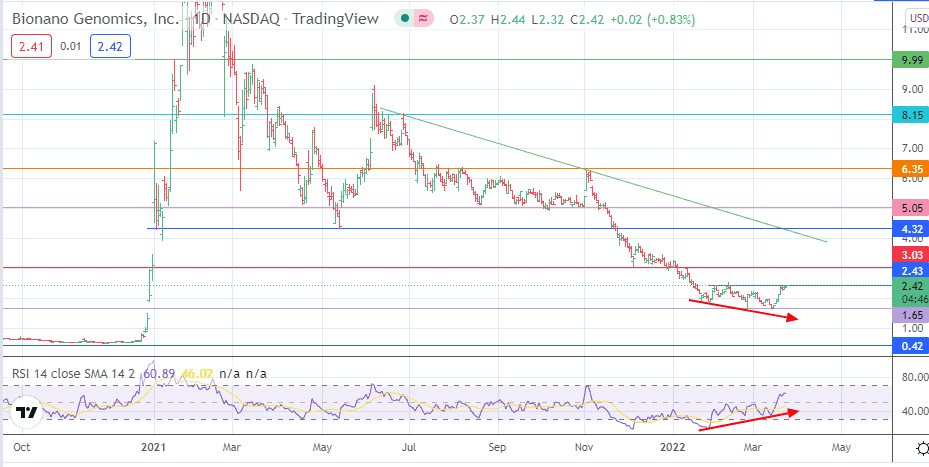

- The BNGO stock price forecast indicates that the $4 price mark is achievable on the break of the current resistance.

A divergence signal on the daily chart of the BNGO stock spurred bullish BNGO stock price forecasts. These forecasts were fulfilled as the price took off from the 15 March low at 1.65 to trade at 2.40. Any bullish BNGO stock price forecasts will face a stiff test as the price challenges the 2.43 resistance level. This level was the site of two peaks that formed the completed double top that terminated at the 1.65 price mark.

The recent bullish had a fundamental trigger. Last Friday, the firm announced that the clinical study it conducted with Augusta and Emory universities supported using its proprietary genomic mapping technology to classify genomic blood cancer variants. The study revealed a 98.7% sensitivity and 100% specificity in detecting structural genomic variants. In addition, the first-pass success rate was 100%, while accuracy was measured at 99.2%.

BioNano Genomics says the data supported using the technology to detect therapeutic targets and clinical trials. The BNGO stock price gained 9% on the news on 18 March and is up 0.83% in Wednesday trading. However, considering that the BNGO stock price had fallen to levels considered as being relatively cheap, the recent upside did not come as a surprise.

BNGO Stock Price Forecast

The BNGO stock price is testing the resistance at the 2.43 price level, formed by the previous double top of 2/10 February 2022. This scenario follows the upside move that corrected the divergence from the RSI indicator. A break of this resistance opens the door for a push towards the 30 December 2020/12 January 2022 highs at 3.03. 4.32 is the next target in line but is only attainable if the bullish action breaks the descending trendline. Finally, additional northbound targets are 5.05 and 6.35 (2 November 2021 high).

On the flip side, rejection at the 2.43 resistance allows the bears to push for a retest of the 1.51 support line. Below this level, 0.42 appears as the next downside target. Finally, however, the 1.00 psychological support may present itself as a pitstop.

BNGO: Daily Chart