The Aviva share price looks set to close firmly higher after a rating upgrade drove new demand for the stock this Thursday. The stock has gained 2.73% and is on course to break a key resistance as it seeks to close out the week at a breakeven point.

The fundamental driver of today’s positive movement on the stock comes from AM Best’s credit rating upgrade after the insurer strengthened its balance sheet position. Aviva has also seen its financial strength rating upgraded to A+. The long-term issuer credit rating was upgraded from a+ (excellent) to aa- (superior).

Aviva looks to build on its previous earnings report, which showed a strong performance as the company aims for a full pandemic recovery. The bullish harami got upside confirmation from the day’s bullish candle. This candle has to close above the resistance by at least 3% penetration to confirm the break.

Aviva Share Price Outlook

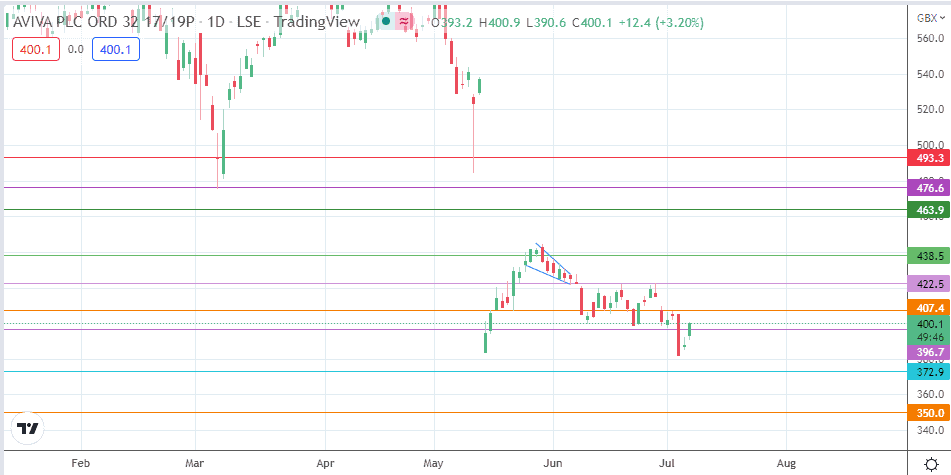

The bullish harami has been followed by an outside day candle that has violated the resistance at 396.7 (17 May 2022 low). Additional push to the north will challenge the resistance barrier at 407.4 (22 June 2022 low and 4 July high). A further break of this level enables the bulls to attain the 422.5 price mark, where the recent highs of 21 June/29 June are found. 438.5 (31 May high) and 463.9 are additional northbound targets.

On the flip side, a decline below the 5 July candle low at 382.3 is required for the bears to gain access to the 372.9 multi-month support level (7 April 2020 high and 10 September 2020 low). Further price deterioration makes 350.0 available (15 June 2020 low). However, the low of 21 October 2020 at the 360.0 psychological price mark may serve as a pitstop for the bears.

AV.: Daily Chart