The AUDUSD pair rally continued in early trading as traders digested the Reserve Bank of Australia (RBA) interest rate decision and data from China and Australia. The pair is trading at 07400, which is the highest it has been since 2018.

The RBA decided to leave interest rates unchanged at 0.25% as most analysts were expecting. The bank also left the yield curve control program intact. In this, the bank is targeting the yield of the three-year government bonds at 0.25%. In addition, the bank decided to expand the term lending facility in its bid to cushion the economy. In this program, the bank is providing funds to banks and other deposit-taking institutions. The goal is to help these companies extend borrowing to companies and households.

At the same time, the bank said that it expects the economic impact of the virus to be better than what was initially expected. It expects the unemployment rate will rise to 10% this year while inflation will be weak. In a statement, Philip Lowe said:

“Wage and prices pressures remain subdued and this is likely to continue for some time. Inflation is expected to average between 1 and 1½ per cent over the next couple of years.”

The AUDUSD pair is also reacting to mixed PMI data. According to the Australia Industry Group, the manufacturing PMI declined to 49.3 from the previous 53.5. It blamed this to the lockdowns that were implemented in Melbourne and Victoria states. Meanwhile, in China, Australia’s biggest trading partner, the manufacturing PMI rose to 53.1 in August.

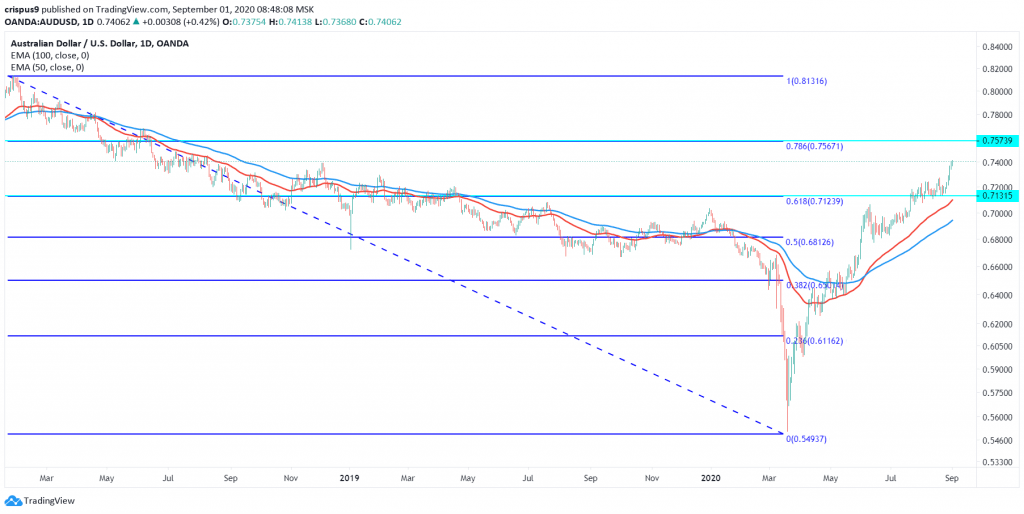

AUDUSD technical outlook

The daily chart shows that the AUDUSD pair has been in a strong upward trend. It has gained in the past seven consecutive days. The pair is above the 50-day and 100-day exponential moving averages. Also, it has moved above the 61.8% Fibonacci retracement level. This retracement joins the highest point in 2018 with the lowest level this year.

Therefore, I suspect that the pair will continue rising as bulls aim for the 78.6% retracement level at 0.7567. On the flip side, a move below the 61.8% retracement level at 0.7131 will invalidate this trend.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dow Jones Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.