- The unfolding geopolitical tension between China and Taiwan could spur safe haven buying, and send the AUD/USD lower.

The AUD/USD has recovered from earlier session lows and now trades 0.16% higher. This follows Tuesday’s steep drop by 1.46% after the RBA delivered a 50 bps rate hike to 1.85%, while at the same time delivering a cautious outlook on monetary policy direction.

Traders were disappointed by the Reserve Bank of Australia’s outlook on future rate hikes, which RBA Governor Philip Lowe said was “not on a pre-set path” after the bank said it expected inflationary conditions to be resolved later in the year. The statement’s tone was deemed dovish, leading to a big selloff on the AUD/USD. The RBA’s position has caused Goldman Sachs analysts to reduce the likelihood of a 50 bps hike in September and October 2022 to 60% and 55%, respectively.

In contrast, hawkish Fedspeak and a recovery in the US long-term bond yields supported the greenback, which had been struggling all week. Yields on the US Treasuries 10-year note rose 6.79% on Tuesday and are presently up another 0.33% on Wednesday to put more pressure on the AUD/USD.

Despite the Aussie Dollar’s recovery on the day, the unfolding geopolitical situation between China and Taiwan on the US House Speaker Nancy Pelosi’s visit could constitute additional headwinds to the AUD/USD’s recovery.

AUD/USD Forecast

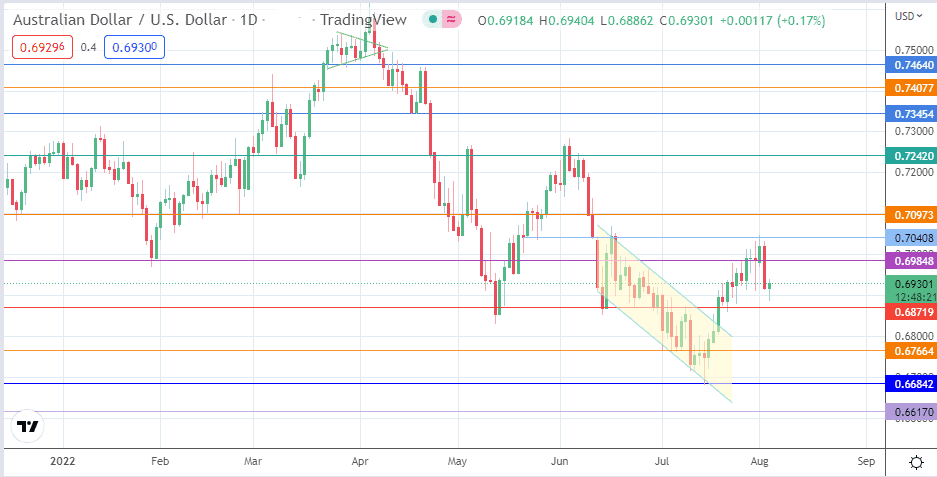

The intraday recovery ensures the price action remains above the 0.68719 support (23 June and 20 July lows). A retest of this support and subsequent breakdown gives the bears a pathway toward the 1/7 July 2022 lows at 0.67664. If the bulls fail to defend this support, 0.66842 becomes the next downside target, being the previous site of the 29 May 2020 candle high and the 15 July 2022 candle low.

This outlook is negated if the bulls gather momentum from the intraday bounce to march toward the 0.69848 resistance. A break above this barrier clears the pathway toward the 13 June/1 August high at 0.70408. A subsequent upside target resides at the 0.70973 resistance (24 February/9 June lows), after which the bulls will have clear skies to aim for the 7 June high at 0.72420.

AUD/USD: Daily Chart