The Aston Martin share price continued its bullish comeback on Thursday after the company published strong results. The stock surged by more than 5% and is trading at 1,830p. The gains add to the 3% increase that it made on Wednesday.

Aston Martin earnings

The recent strength of the global economy has had a major impact on the luxury car industry. Aston Martin has not been left behind.

The company announced that its wholesale volume rose to more than 4250 year-to-date. This was a 173% increase from the same place in 2020. In the third quarter, the company sold 1,350 cars, up from 660 cars in the same period in 2020.

Its revenue jumped from 124 million pounds in Q3 2020 to more than 237 million pounds while its loss narrowed to about 30.2 million pounds. The company also managed to lower its debt by about 68 million pounds. Aston Martin attributed its success to the strong performance of DBX. In a statement, the company’s CEO said:

“Our excellent progress on ‘Project Horizon’ as we drive efficiency and agility throughout our business is delivering results with further operational milestones of consolidating our paint shops and restructuring our St Athan operations completed during the quarter.”

Aston Martin Lagonda, which is a member of the FTSE 250, expects that its wholesale sales for the year will be about 6,000 cars. Therefore, there is a likelihood that the company will keep doing well in the near term since the number of wealthy young people is growing. Think of all those silent crypto millionaires out there.

Aston Martin share price forecast

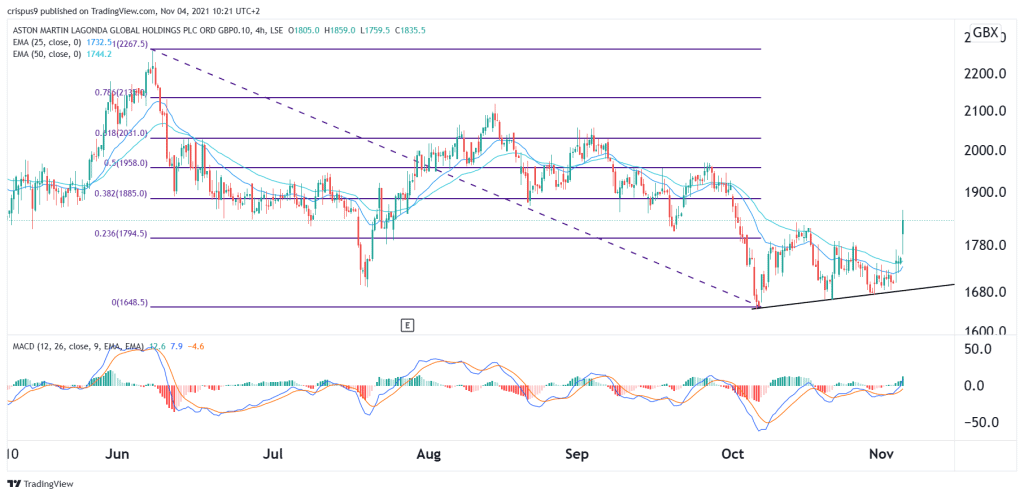

The four-hour chart shows that the Aston Martin share price has jumped sharply today. We also see that the stock remains above the ascending trendline shown in black, which is a sign that it may have bottomed.

It has also moved above the 23.6% Fibonacci retracement level while the 25-day and 50-day moving averages have risen. Therefore, the next key level to watch will be at 1,959p, which is along the 50% retracement level. On the flip side, a drop below 1,7800p will invalidate the bullish view.