- The Apple stock price forecast indicates the potential for headwinds to arise with passage of new laws targeting big tech companies.

The Apple stock price forecast is for a potential opposition to its continued advance as a fallout of recent attempts by regulators worldwide to curtail the prowess of big tech companies.

The US Department of Justice )DoJ) has lent its support to the American Innovation and Choice Online Act, which seeks to bar large digital platforms such as the type Apple provides from pushing their products and services ahead of other competitors. The DoJ has singled out digital media of Apple, Alphabet’s Google, and Amazon as companies it says are stifling market competition.

The DoJ’s stance comes a few days after EU lawmakers passed the Digital Markets Act, which among other things, also seeks to prevent big tech companies from pushing their products ahead of the competition on their digital platforms.

Apple Inc responded to that development, saying it was concerned about some of the new law’s provisions. Apple also said it would create security and privacy vulnerabilities for its users. It also noted that the new law would prevent the company from applying appropriate charges to recoup its heavy investments in intellectual property.

The Apple share price has enjoyed several days of gains before these developments, as tech stocks have enjoyed patronage following the Fed’s interest rate lift-off on 16 March. As a result, the stock is trading marginally higher in premarket trading.

Apple Stock Price Forecast

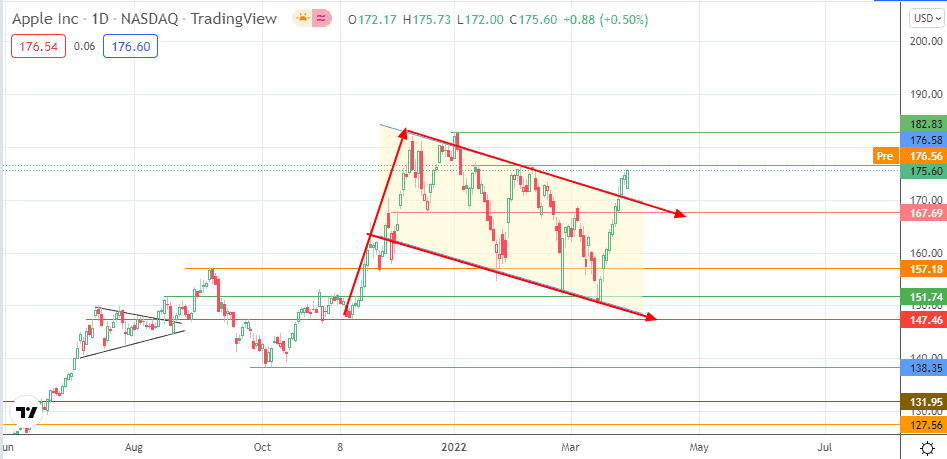

The renewed bullish push is expected to test the 12 January/3 February highs at 176.58. This move can be seen in the context of the breakout from the bullish flag on the daily chart. The bulls need to uncap this resistance 1y 176.58 to continue the upside move towards 182.83, the measured move’s completion point.

On the flip side, rejection at 176.58 truncates the measured move from the pattern and could initially force a pullback that targets 167.59. If this pivot breaks down, the bullish flag’s measured move is invalidated, and the bears would have a clear pathway towards 157.18 (26 November and 25 January 2022 lows). Below this level, 151.74 and 147.46 are additional targets to the south.

Apple: Daily Chart

Follow Eno on Twitter.