- The AMC stock forecast is for the price action to see more downside moves, after the combined 23% loss seen on Wed and Thursday.

The steep decline of the last two days has enhanced bearish AMC stock forecasts. The evidence for this lies at the current premarket price of 17.86, which indicates the potential for a further decline after yesterday’s candle closed at 19.29.

So what triggered the steep decline and the accompanying bearish AMC stock forecasts? This comes from the selloff seen in meme stock Bed Bath & Beyond, following the rumoured sale by Ryan Cohen of his stake in the company.

Ryan Cohen’s RC Ventures owns a 10% stake in Bed Bath and Beyond, and Cohen also happens to be the Chairman of another meme stock company, GameStop. An SEC filing indicates that Cohen is selling 9.4 million shares of BBBY, which has led to a steep drop in the BBBY stock price. This drop has dragged AMC along with it, resulting in a combined loss of more than 23% in the last two trading sessions.

AMC Entertainment’s CEO Adam Aron remains optimistic that the renewed demand for its movie theatre portfolio will enable it to meet its earlier announced forecasts.

AMC Stock Forecast

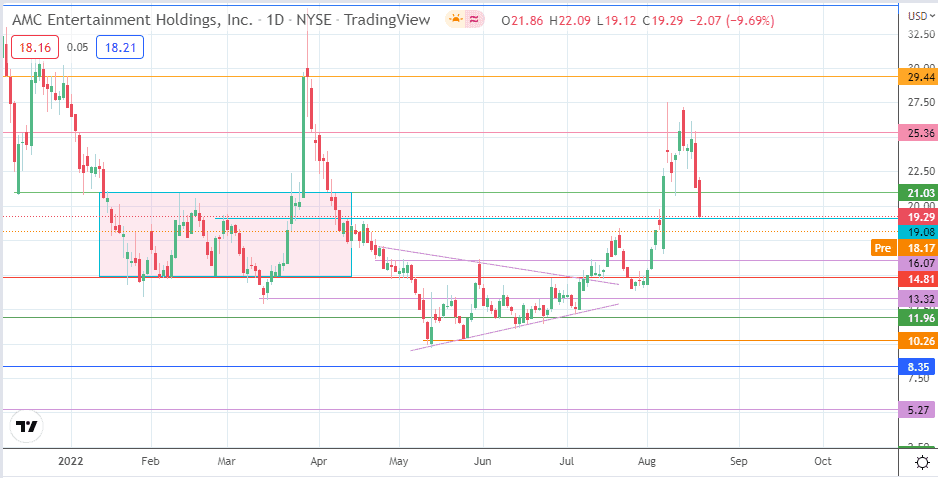

There is a lot of bearish pressure on the stock, making the 19.08 support vulnerable. A breakdown of this support level clears the pathway toward the 16.07 support, formed by the 3 May, 31 May, and 12 July 2022 highs in role reversal. Below this pivot, the price action may find additional support at 14.81. Finally, targets at 13.32 (former neckline of 11 May/24 May double bottom) and 11.96 (7 June and 24 June lows) form additional downside pivots, which need to hold to prevent a further cascade toward 10.26 (prior double bottom).

On the other hand, a bounce on the 19.08 support is required to stave off the scenario painted above. Furthermore, this bounce must break the 21.03 resistance (10 February and 7 April highs) before 25.36 can become a viable target.

However, there is a potential pitstop at 22.50, where the previous highs of 23 March and 8 August 2022 are located. The 25.36 barrier (5 January, 1 April and 17 August highs) will have to stay intact to prevent a further push to the north. Otherwise, clearance of this price mark puts the crosshairs of the bulls at 29.44 (31 December 2021 and 28 March 2022 highs).

AMC: Daily Chart