- Amazon's share price fell 2.86% on Thursday after further stock market losses. The Nasdaq was the biggest loser of the indices again with a 1.99% drop.

Amazon’s share price fell 2.86% on Thursday after the stock market saw further losses. The tech-heavy Nasdaq was the biggest loser of the indices again with a 1.99% drop on the day. Amazon is now testing the 50-day moving average and bullish traders will be hoping for a bounce today for a positive end to the week.

News for Amazon was that India’s largest retailer, Reliance Industries, has offered to sell the Seattle-based giant a 40% stake in its retail arm- a deal that could be worth $20 billion according to Bloomberg. Reliance has 11,000 outlets which are mostly in India and a deal of this size would be one of Amazon’s largest. Reliance also owns the JioMart e-commerce platform, which is a fast-growing rival to Amazon in India.

Rumours of this deal have swirled in the past with talk of a 9.9% and 26% stake. Reliance retail turned over almost $20 billion in the year to March 2020, which was an increase of 27% on the previous year. The Retail arm is a subsidiary of the Reliance Industries conglomerate which is owned by Asia’s richest man, Mukesh Ambani. The company has interests in various sectors including energy and telecoms.

Reliance has already attracted investments from Facebook and Google this year for its Jio Platforms mobile internet service. The deal would be an opportunity for both companies to capitalize on the current high stock valuations. If the deal is made official then we could see Amazon stock dip further.

On the upside, first resistance for the Dow index stands at 25,601 the high from yesterday. A move above 25,601 might open the way for a test of 25,027 the high from June 24. If the bulls continue then the next supply zone for the Dow Jones is at 26,274 the 200-day moving average.

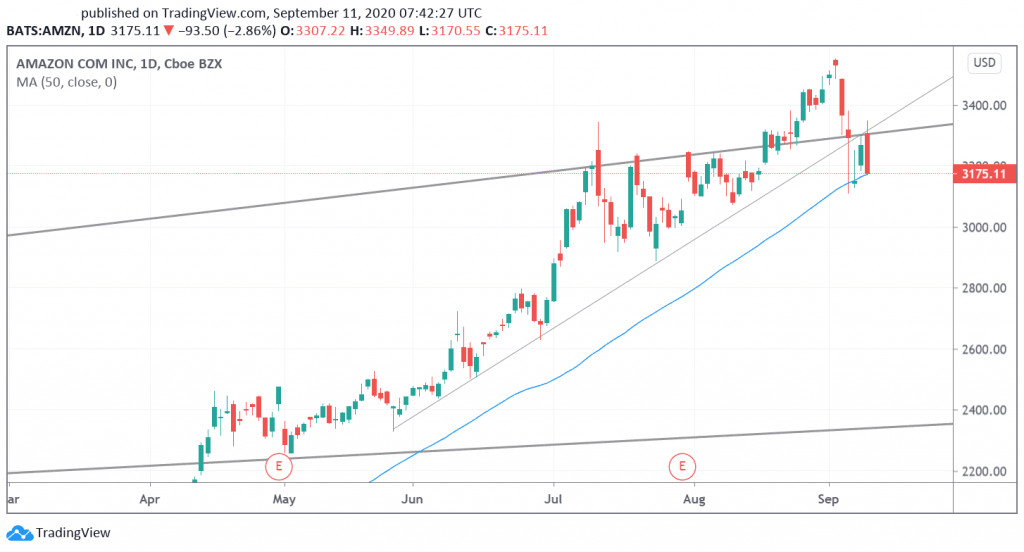

Amazon Technical Outlook

The drop in Amazon has been another failure at uptrend resistance and the price now tests the 50-day moving average. A move lower will test support at the $2,900-3,000 level on the stock. $2,600 is the next level for a deeper sell-off. A daily close above the resistance line would be a stop loss for shorts, or a chance to get long. The Investing Cube Trading Course can help with trading strategies. Find details here. The team is also available for personal coaching on the markets.