- The Amazon share price has found a strong support at $101. We explain what to expect in the near term as the shares collapse.

The Amazon share price has found strong support at $101. On Tuesday, the AMZN stock jumped sharply and ended the day at $113, which is about 12% above the lowest level last week. This rebound brought the company’s market cap to more than $1.1 trillion. Other big-tech stocks like Meta, Tesla, and Microsoft also bounced back.

Is AMZN bottoming?

Amazon has been going through major headwinds this year. First, the rising inflation has affected demand for its Amazon Retail solutions. Data published in June showed that America’s inflation surged to the highest point in over 40 years in May. As a result, more people are now tapping into their savings, meaning they are buying less discretionary products from Amazon.

Amazon is also struggling as business confidence slips. Confidence among corporate heads has declined sharply in the past few months. For example, companies with international exposure are now seeing their earnings disappear because of the strong dollar. As a result, analysts believe that spending on cloud computing will decline in the coming months.

Amazon has also suffered because of the ongoing technology rout that has seen the value of its holdings evaporate. For example, Amazon is one of the biggest holders of Rivian shares. As a result, the Rivian stock price has crashed from about $180 to below $30. Other tech firms that Amazon has invested in have followed the same script.

Most importantly, there is a possibility that the growth of Amazon’s ad business will continue slowing down as business growth deteriorates.

Amazon share price forecast

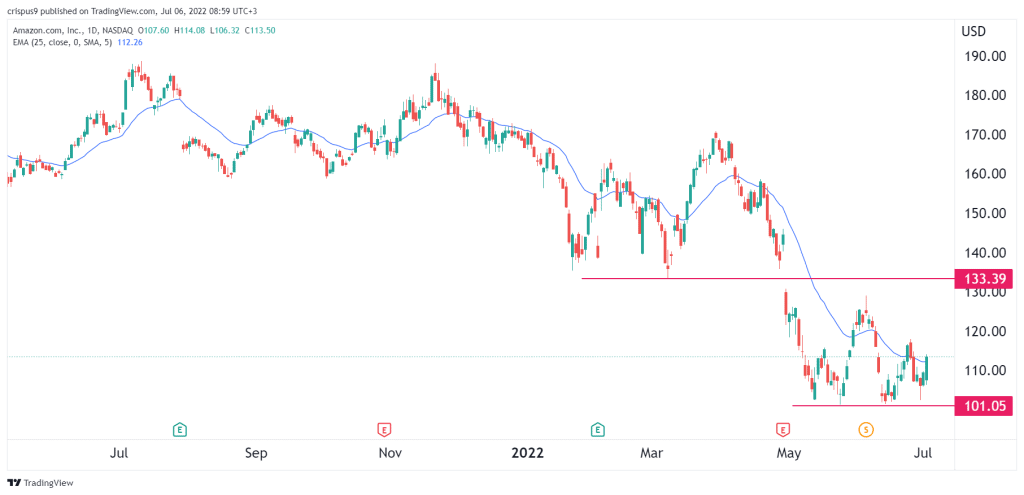

The daily chart shows that the AMZN stock price has recently been in a strong downward trend. The sell-off accelerated when the stock crashed below the important support at $133, which was the lowest point in March.

Now, the shares have formed what looks like a head and shoulders pattern whose neckline is at $101. It is also below the 50-day moving average. Therefore, the stock will likely have a bearish breakout in the coming weeks. If this happens, the next key support to watch will be at $90. A move above the right shoulder at $120 will invalidate the bearish view.