Alibaba stock price popped by more than 11% on Tuesday as investors focused on the meeting between Joe Biden and Xi Jinping. BABA shares jumped to $79, which was the highest level since October 10 of this year. It has rebounded by over 36% from the lowest level this month. Other Chinese stocks listed in the United States like Miniso, Iqiyi, TAL Education, and Baidu also rallied.

Is Alibaba a good stock to buy?

Alibaba is one of the biggest fallen angels in the stock market. The stock did well a few years ago, which helped push its market cap to over $830 billion. At the time, it was one of the biggest companies in the world.

Recently, however, Alibaba share price has plunged by more than 75% amid concerns about Beijing. The government has imposed several regulations that have eroded investors’ confidence of Chinese companies.

For example, in 2020, the government stopped Ant Financial IPO and ordered the firm to change its business model. As a result, a company that was valued at over $300 billion now has a smaller market value than that. Investors like Fidelity and Blackrock value the company at about $151 billion.

Alibaba stock price has also crashed as Softbank has continued selling its stake in the company. This is notable since SoftBank is one of the company’s biggest investors. Further, there are concerns about the rising tensions between the United States and China. A key issue is Taiwan, which China is expected to invade in the next few years.

Biden-Xi meeting

BABA stock price jumped after Biden and Xi held a meeting in Bali. The two leaders committed to deepening their engagement on key issues like climate change and international security. Biden also said that the US was not interested in a conflict with China.

Still, it is hard to take these talks seriously for now. Also, they will likely have no major impact on Alibaba’s business. The business has continued doing well even as global inflation continues rising. The most recent results showed that the company’s revenue was $30.6 billion, lower than the $31 billion it made in the same period in 2021. Its profit also moved below $6.6 billion to $3 billion.

Alibaba stock is significantly undervalued considering that it has a PE ratio of 9.7, lower than the sector median of 10.25. Its forward PE is 9.82, also lower than the sector median of 13.

Alibaba stock price forecast

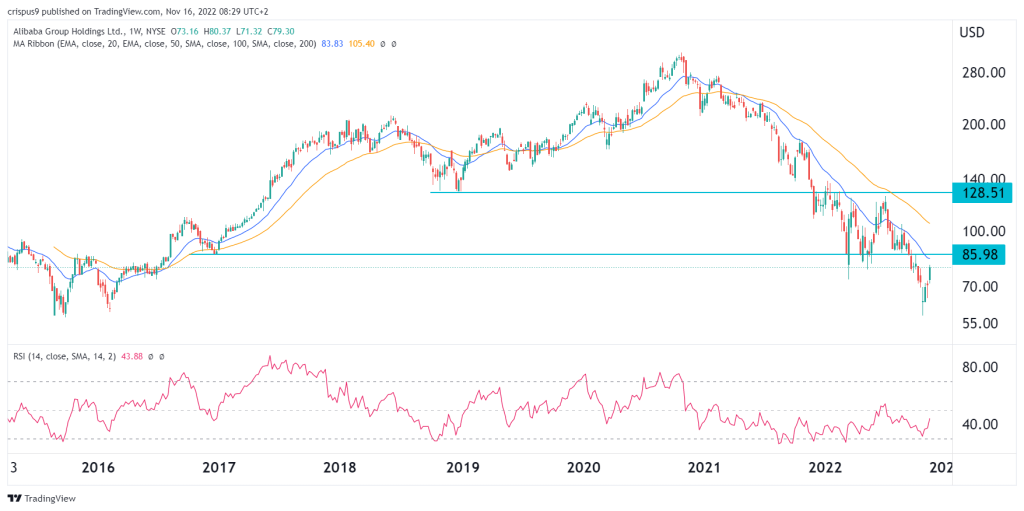

The daily chart shows that the BABA stock price has made a strong recovery in the past few days. It has managed to move from the year-to-date low of $58.08. The stock managed to move below all moving averages. It is also slightly below the important resistance level at $85.98, which was the lowest level on June 2016.

The Relative Strength Index (RSI) moved slightly above the oversold level of 30. Therefore, while the recent rebound is a positive thing, a more steady recovery will be confirmed if it manages to move above the 50-day moving average at $100.