Indian equities are walking into Thursday’s session under the shadow of a fresh trade blow. US President Donald Trump has announced a 25% tariff on Indian imports, effective August 1, shaking up sentiment across Asia and sparking concerns over a deeper rift between Washington and New Delhi.

And yet, the opening indicator says otherwise.

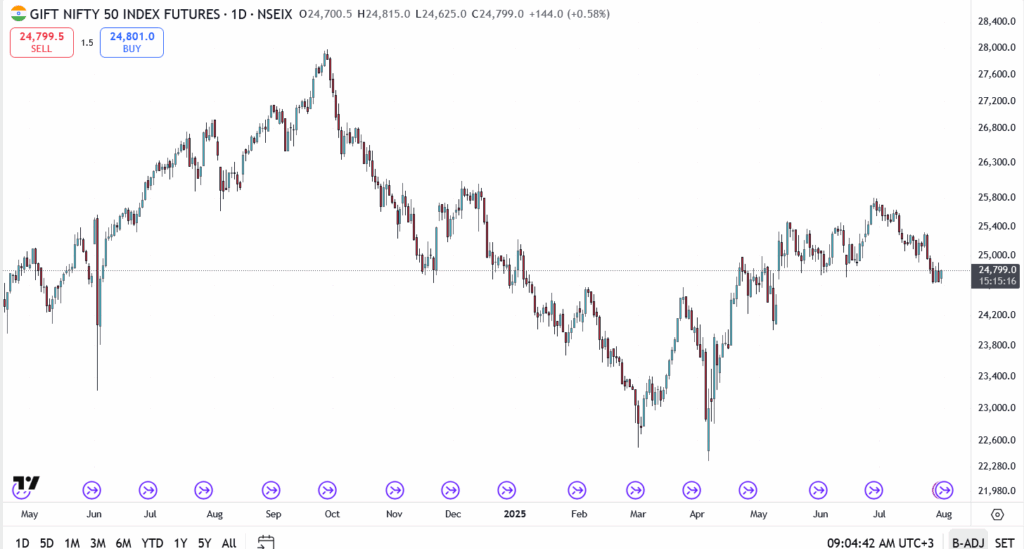

GIFT Nifty futures have risen 144 points to 24,799, defying the bearish tone that dominated headlines overnight. The move suggests that Indian investors are willing to look past the noise, for now, and position themselves ahead of today’s critical Federal Reserve policy decision.

Export-heavy stocks, particularly in the pharma, auto components, and IT sectors, may face heat as the tariff takes aim at some of India’s biggest contributors to the trade balance. There’s also unease around possible secondary sanctions tied to India’s defense and energy dealings with Russia.

But in typical market fashion, the index is doing the opposite of what sentiment might dictate, bouncing off key support and catching short sellers flat-footed.

GIFT Nifty Chart Outlook

- Current price: 24,799

- Resistance levels: 25,050 and 25,400

- Support zones: 24,600, then 24,250

Price action shows a clean rebound off the 24,600 area after a multi-day slide. Bulls will want to hold that zone through the US Fed announcement later today. A break above 25,050 could flip the script heading into August.

Conclusion

Despite the overnight tariff shock, India’s market isn’t panicking. Not yet. That’s not to say the impact won’t show up later, especially if US-India tensions escalate or the Fed leans hawkish. But this morning’s open is a reminder: markets move on positioning, not headlines.

Whether this bounce has legs will depend on how today’s global events unfold. For now, GIFT Nifty is holding the line, and that says a lot.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.