Eternal Ltd (NSE: ETERNAL) surged nearly 8% intraday on Monday before settling 5.64% higher at ₹271.70. The rally came despite a 90% plunge in Q1 FY26 net profit to just ₹25 crore. Instead of punishing the stock, investors rewarded a major shift in the company’s growth narrative, Blinkit has now officially overtaken Zomato as Eternal’s top-performing B2C business.

Blinkit Leads as Quick Commerce Revenue Surges 154%

Eternal’s topline told a different story from its bottom line. Total revenue from operations rose 70% YoY to ₹7,167 crore, driven largely by Blinkit’s strong performance. The quick commerce arm reported revenue of ₹2,400 crore, up 154% from ₹942 crore a year earlier. Food delivery, led by Zomato, posted ₹2,261 crore in revenue, a modest 16% YoY increase.

This was the first quarter where Blinkit’s net order value surpassed that of Zomato. On an annualized basis, we’re now close to $10 billion in NOV across our B2C businesses, with quick commerce contributing nearly half.”

CFO Akshant Goyal said during the earnings call.

The message to the market was clear: Blinkit isn’t just a growth story, it’s the new core of Eternal’s consumer business.

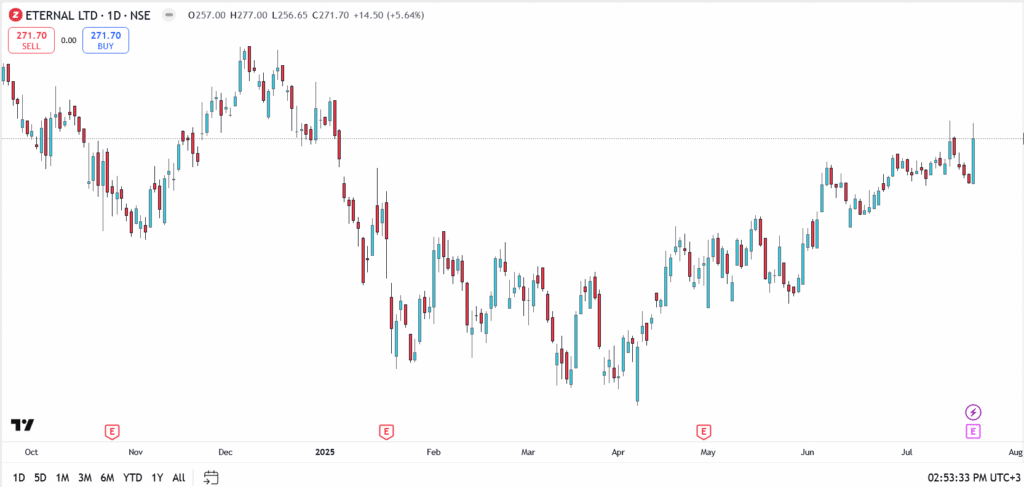

Eternal Share Price

- Current price: ₹271.70

- Intraday high: ₹277.00

- Resistance zones: ₹277.00 , ₹290.00

- Support zones: ₹256.00 , ₹240.00

Outlook: Blinkit Steals the Show

Eternal’s results highlight a bold pivot away from food delivery dominance toward a quick commerce-led future. While profits have slumped, topline expansion and Blinkit’s momentum are convincing investors that Eternal is on the right side of India’s retail evolution.

If momentum holds, ₹290 could come into focus, and the stock may start pricing in Blinkit’s future cash flow dominance ahead of any full spin-off or IPO.