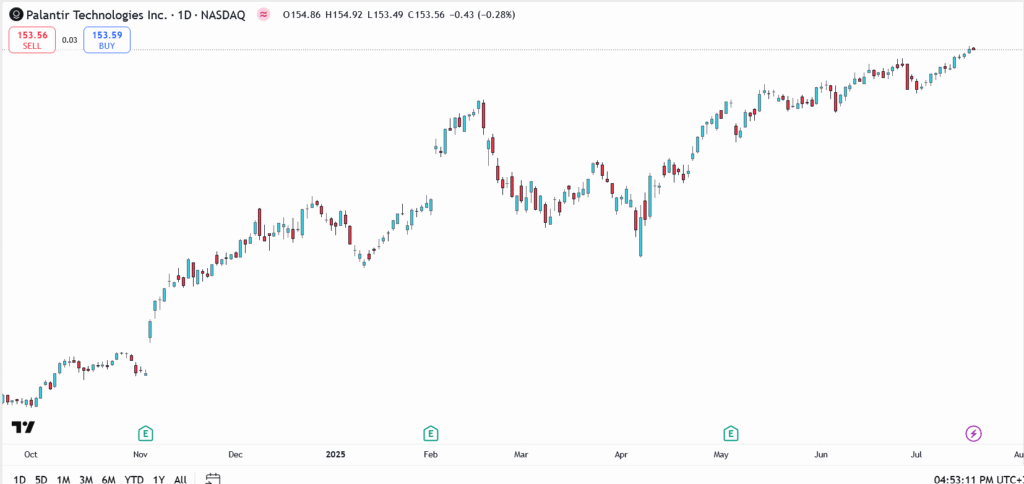

Palantir Technologies Inc. (NASDAQ: PLTR) continues to trade near record territory, holding firm around $153.56 in Thursday’s session despite a slight dip of 0.28%. The stock briefly touched a new 52-week high of $154.92 earlier in the day, as bullish sentiment builds ahead of the company’s Q2 earnings report scheduled for August 4.

With institutional upgrades and AI momentum fueling investor optimism, PLTR has now gained more than 40% over the past eight weeks. Analysts are watching closely to see if the stock can maintain this momentum and break through the psychological $160 level in the coming days.

Palantir Stock Boosted by AI Demand and Upbeat Forecasts

Recent trading activity has been driven by a mix of technical strength and growing expectations for another robust quarter. Analysts are forecasting 38% revenue growth and a 54% surge in earnings, driven by continued expansion in AI contracts across government and commercial sectors.

Investor sentiment also got a lift this week after a major rating firm revised its stance on Palantir from “underperform” to “neutral,” while raising its price target. The upgrade cited accelerating AI adoption and stronger-than-expected government deal flow, though valuation concerns were still noted.

Palantir Share Price Levels to Watch

- Current price: $153.56

- Resistance: $154.92, followed by $160.00

- Support: $149.80, then $145.00

- Trend: Strong uptrend with higher lows intact since early June

- Volume: Holding above average, confirming bullish control

As long as Palantir holds above the $150 pivot, technical traders expect further upside. A clean breakout above $155 could open the door to a test of $160 ahead of earnings.

Outlook: Is PLTR Still a Buy at These Levels?

Palantir has firmly established itself as a core AI infrastructure play, with its Apollo and Foundry platforms seeing expanded use cases in both public and private sectors. The company’s ability to scale contracts, especially in defense, has helped justify recent valuations.

However, as the stock enters overbought territory, some investors are urging caution. Forward multiples remain rich, and the bar is now high for Q2 results to impress.

Still, momentum traders remain bullish. With earnings just two weeks away and AI hype showing no signs of cooling, Palantir’s share price appears to be building a new base, not topping out.