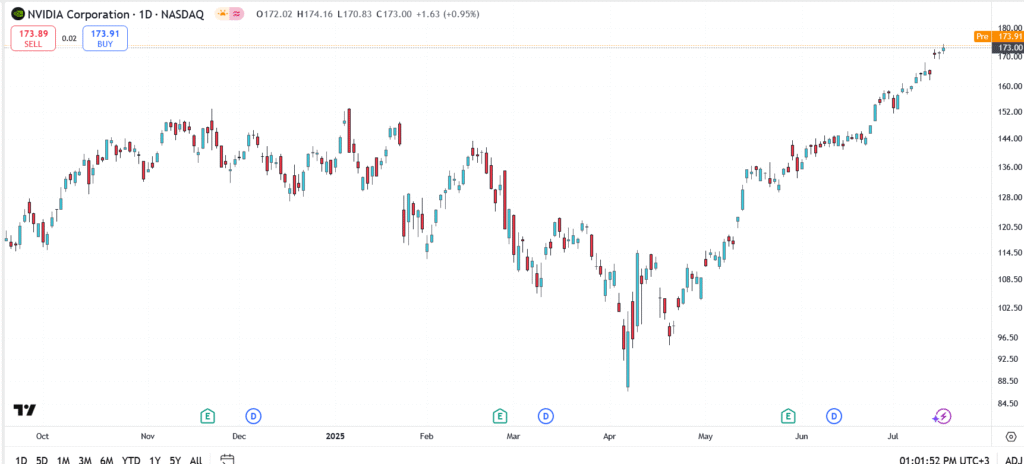

Nvidia (NASDAQ: NVDA) is trading higher in Friday’s pre-market session, up 0.8% to $173.91 as momentum continues to build around its expanding AI chip footprint and improving trade signals from China. The stock is on track for its eighth straight weekly gain, with bulls now setting sights on the key psychological level at $180.

Nvidia Share Price Gains on Strengthening China Demand

Investor focus has sharpened around Nvidia’s re-entry into the Chinese AI market. After months of tight export controls, high-level discussions this week appear to have laid the groundwork for selective chip access to resume. Market participants are interpreting this as a green light for Nvidia’s next wave of growth in Asia, particularly through custom GPUs built to meet compliance thresholds.

The stock’s advance reflects growing confidence that China-linked AI revenues may return faster than expected. For a company already dominating global data center demand, any incremental upside from Asia could push valuation multiples even higher in the near term.

TSMC Profit Surge Underscores AI Chip Boom

Nvidia’s upside is also riding on the broader strength of its supply chain. Its primary manufacturing partner just reported a 61% jump in quarterly profit, powered by surging demand for high-performance AI chips. That segment now accounts for over 60% of overall revenue, evidence that the industry’s most advanced chip designs are seeing massive uptake.

This bodes well for Nvidia’s flagship products, which rely on the most cutting-edge nodes available. With volume orders expanding and fabrication pipelines operating at full tilt, Nvidia appears well-positioned to scale production in the second half of 2025.

Nvidia Share Price Forecast: Breakout Levels to Watch

- Current price: $173.91 (pre-market)

- Immediate resistance: $174.50

- Major breakout target: $180.00

- Support zone: $166.80, then $160.50

- Trend: Strong bullish continuation, higher lows remain intact

The recent rally has been built on clean technical structure and volume-backed buying. If price clears $174.50 with conviction, a move toward $180 looks increasingly likely, especially if macro sentiment remains supportive.

Nvidia Stock Outlook: Is a New All-Time High Coming?

As AI chip demand explodes across cloud, robotics, and enterprise applications, Nvidia remains one of the few firms with the capability to deliver at scale. Add in the potential reopening of one of its largest international markets, and the growth runway looks extended, not exhausted.

Traders are now watching for any updates on upcoming earnings guidance, as well as delivery timelines tied to new geopolitical trade channels. With bulls firmly in control, Nvidia’s share price may not stop at $180, especially if the AI narrative continues to accelerate through Q3.