- Stock markets today: Nifty 50 drops below 25,100 while Sensex plunges 300 points as tech stocks weigh on sentiment...

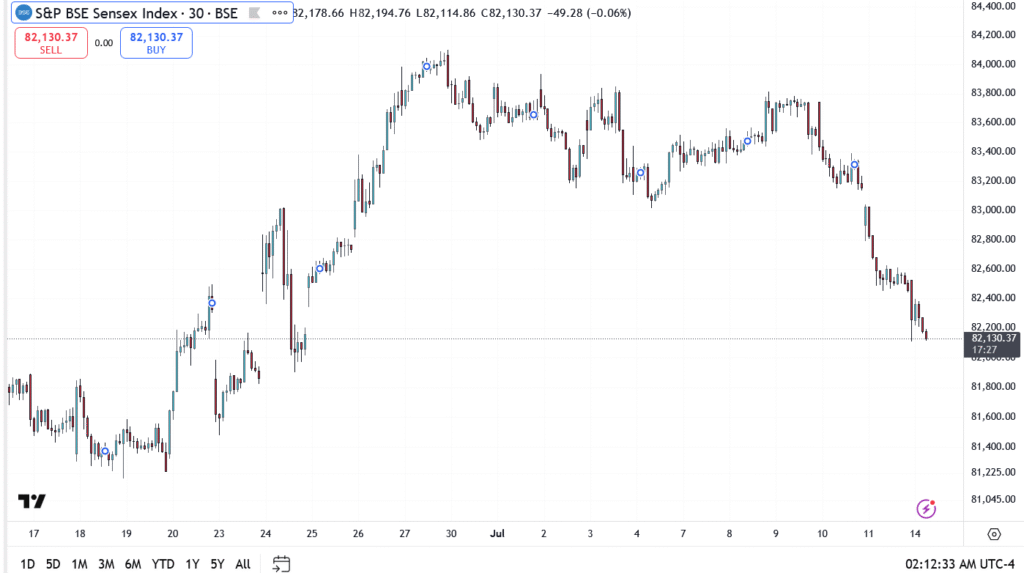

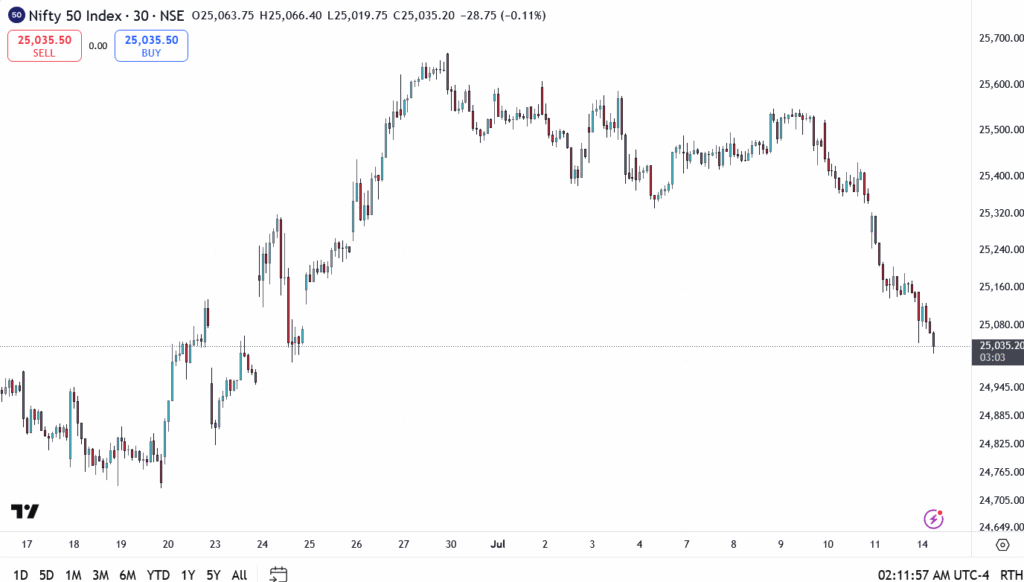

Stock markets today started off flat but quickly sank, with both Nifty 50 and Sensex falling deeper into the red. For a fourth straight session, the pressure has refused to ease, and Monday’s tone was no different.

The Nifty 50 gave up the 25,100 level within the first hour, weighed down by IT stocks and weak global sentiment. Meanwhile, the Sensex slid over 300 points, trading near 82,170 at one stage as bears tightened their grip.

PSU Banks Outperform, Tech Takes a Hit

Across the board, sectoral performance was mixed. Nifty PSU Bank emerged as a quiet outlier, holding firm with a 0.6% uptick. In contrast, Nifty IT dragged the market lower, losing more than 1%, led by declines in Infosys, HCL Tech, and Tech Mahindra.

Big names like Bajaj Finance, HUL, and L&T were also under pressure. On the flip side, Sun Pharma, Power Grid, and SBI managed to stay green, but the leadership was thin.

Global Tensions and Trade Uncertainty Weigh

Investors are watching for clarity on a possible US-India trade deal, with expectations building around a 20% tariff cap. But the lack of confirmation is starting to hurt risk appetite. The fear? That any delay could turn this mild correction into something steeper.

VK Vijayakumar, Chief Strategist at Geojit, noted that FIIs turned aggressive sellers last Friday, especially in tech. He also pointed out that banking stocks are still holding up, thanks to early pricing in of margin compression.

Outlook: More Pain or a Turn For Indian Markets?

This market isn’t panicking, but it’s tired. Global cues are muddy, and the trade war noise isn’t helping. With Wall Street weak, Asia jittery, and commodity moves adding to the uncertainty, local bulls have little reason to chase highs.

Until that tariff deal is locked, expect more chop. For now, Nifty 50 and Sensex are stuck in pullback mode, and the weight of global headlines is getting heavier by the hour.