Bitcoin is back in the driver’s seat after defending $106K, dragging sentiment higher across the board. Ethereum’s been coiling just beneath a major breakout line, while XRP tightens into a corner with barely a headline. The bulls may be quiet, but they’re not sitting still.

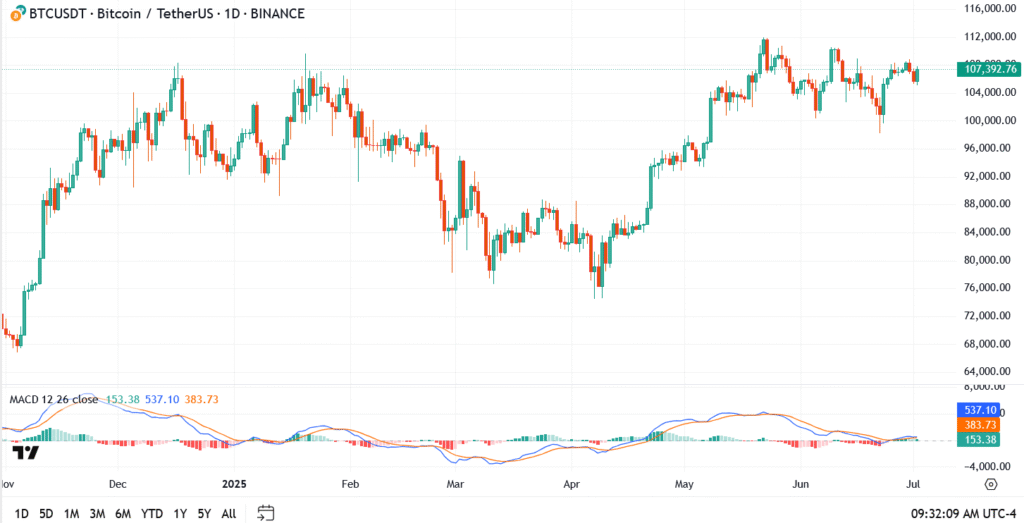

Bitcoin Price Outlook: Bulls Hold the Line as $108.5K Looms

Bitcoin is holding steady near $107,000 on Tuesday after Monday’s brief dip to $106,100. Last week’s move to $108,800 lost steam at familiar resistance, but overall sentiment remains constructive. Spot ETF inflows just notched their 15th straight day of gains, while trading volume continues to firm, signs that institutional demand is quietly doing the heavy lifting.

Last week’s run to $108,800 drew some profit-taking, but BTC hasn’t flinched. The pullback barely scratched $106K before dip-buyers stepped in again, a familiar pattern lately. ETFs are still pulling weight, with flows ticking higher, and the market isn’t showing signs of stress.

Momentum isn’t explosive, but it’s quietly firming. BTC is grinding just above the psychological comfort zone, and that’s keeping sellers cautious. Indicators show steady pressure under the hood not flashy, but functional. If $108.5K cracks cleanly, that could trigger a short squeeze and push BTC into the $110K conversation again.

For now, the $106K–$107K zone is behaving like a launchpad. Unless bears break that footing, the broader uptrend remains intact, with BTC still within reach of retesting its all-time highs.

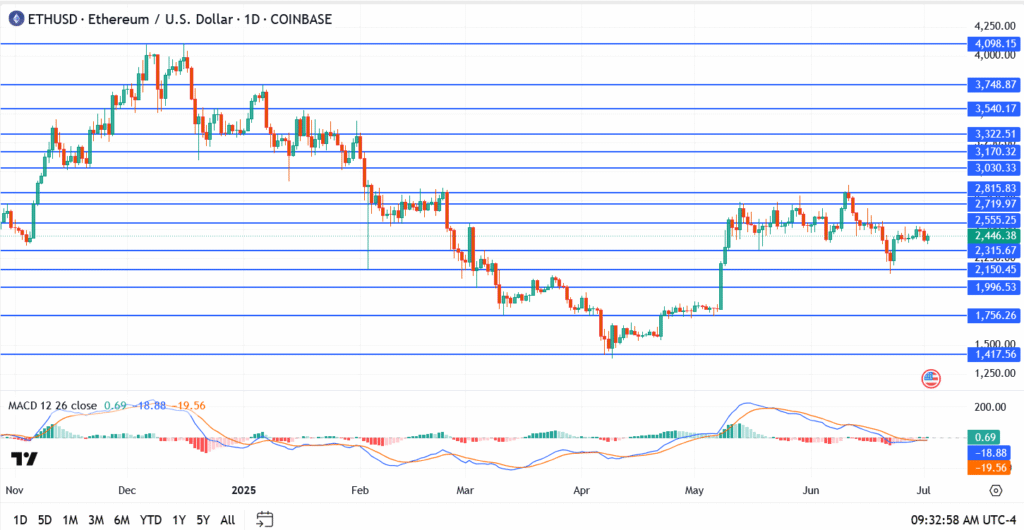

Ethereum Price Today: Bulls Defend $2,430 as ETF Flows Support the Structure

Ethereum is trading just above $2,440 on Tuesday, stabilizing after last weekend’s rejection near $2,495. The move was no surprise, that zone has consistently triggered selling. But bulls are far from done. Spot ETF inflows remain solid, and ETH is still riding the coattails of broader institutional demand that’s propping up the entire altcoin space.

The current structure shows resilience. Ethereum held above its 20-day moving average during Monday’s pullback, and the $2,420–$2,430 range is starting to behave like base support. RSI is leaning neutral at 52, and MACD is gently turning up, not explosive, but enough to keep bears off balance.

The real story sits at $2,500. That level has been a ceiling for weeks. A clean close above it, especially with ETF tailwinds, could open the path toward $2,580, and possibly even $2,640 if momentum builds. But until then, price action will likely stay coiled between familiar levels.

Traders watching ETH should keep an eye on volume. A spike near $2,495 would hint that a breakout is brewing. For now, Ethereum remains constructive, not euphoric, but definitely not out of gas either.

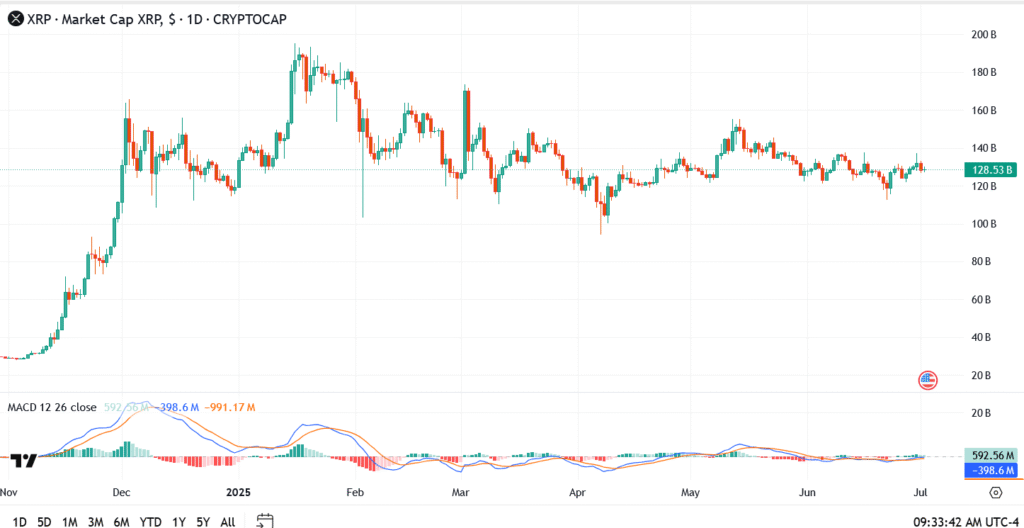

XRP Price Today: Bulls Hold the Line at $0.54 as Breakout Watch Builds

XRP is holding steady near $0.546 on Tuesday after a brief dip below $0.54 in early trading. Despite recent sluggishness, the token has refused to roll over, a sign that buyers are still defending the mid-June range. The broader mood across altcoins has cooled, but XRP’s structure remains intact.

The chart shows price wedging between a rising support line and horizontal resistance just under $0.56. This coil has been forming for days, and volume is starting to compress, often a precursor to an explosive move. MACD is slightly positive, while RSI sits at 48, suggesting consolidation rather than a full-blown fade.

The $0.558 level is the near-term hurdle. A daily close above it could flip the script and open the door toward $0.582, a level that last triggered rejection on June 19. On the downside, $0.532 remains the must-hold floor. A break below that zone could accelerate losses to $0.518.

For now, XRP looks like it’s gathering fuel. It’s not breaking down, but it’s also not ready to run yet. Patience is key. When it moves, it likely won’t whisper.

This article is also available in: Polski, Nederlands, हिन्दी, Deutsch.