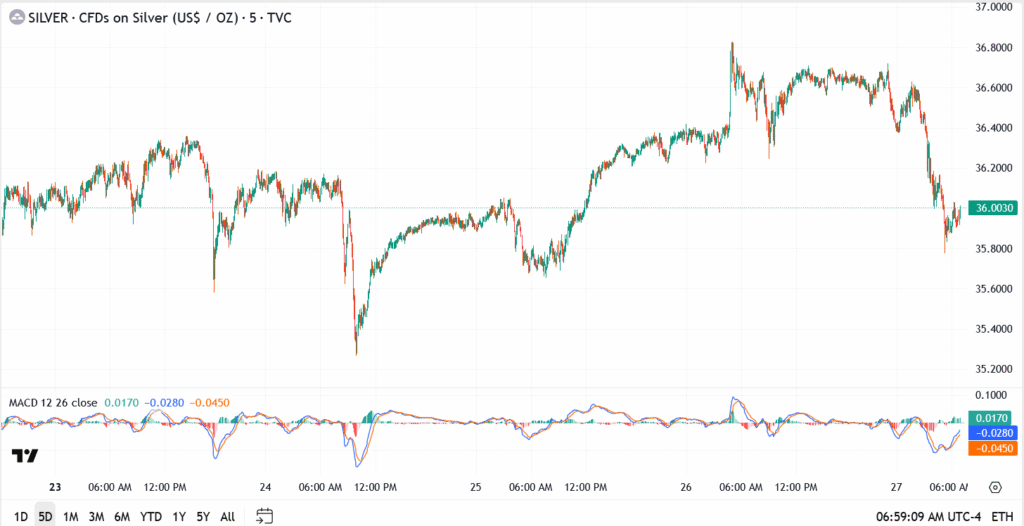

Silver prices are back under pressure, with spot silver (XAG/USD) slipping below $36.00 after an overnight high near $36.85. The move comes on the heels of a risk-on wave in equity markets and a stronger U.S. dollar, both of which clipped the metal’s recent bullish momentum.

Risk Appetite Trims Silver’s Shine as $36 Slips

Silver is trading at $35.98 after a steep slide in early European hours. The pullback appears driven more by positioning than panic, with broader markets showing a tilt toward risk assets. Equities are firm, crude is rebounding, and the dollar’s modest bounce is cooling appetite for metals. No fresh geopolitical spark or macro shock explains the move , this is traders cashing in after silver’s grind higher all week.

Technical Outlook: $36 Faces a Real Test

The chart shows a clean rejection just below the $37.00 handle, with MACD indicators flipping into bearish territory. For now:

- Resistance: $36.40 and $36.85

- Support: $35.60, then $35.20

Unless silver reclaims $36.40 quickly, bears may drag it back toward the lower $35s, especially if the dollar continues to firm.

Traders Eye Fed Signals and Inflation Reads

Looking ahead, the metal’s path will hinge on fresh U.S. inflation figures and what the Fed has to say next. If policymakers hint that rate cuts are still a long way off, silver might struggle to build any serious upside. On the flip side, renewed jitters, whether from geopolitical flashpoints or a weaker dollar, could quickly bring buyers back into the mix.

For now, though, the message from the market is pretty straightforward: $36 needs to hold, or silver could be in for a deeper pullback.

This article is also available in: Polski, Nederlands, हिन्दी, Deutsch, Italiano, Español, Türkçe.