- WTI crude plunges below $65 as Iran strikes a U.S. base. Panic selling grips oil markets amid airspace shutdowns fears of further escalation.

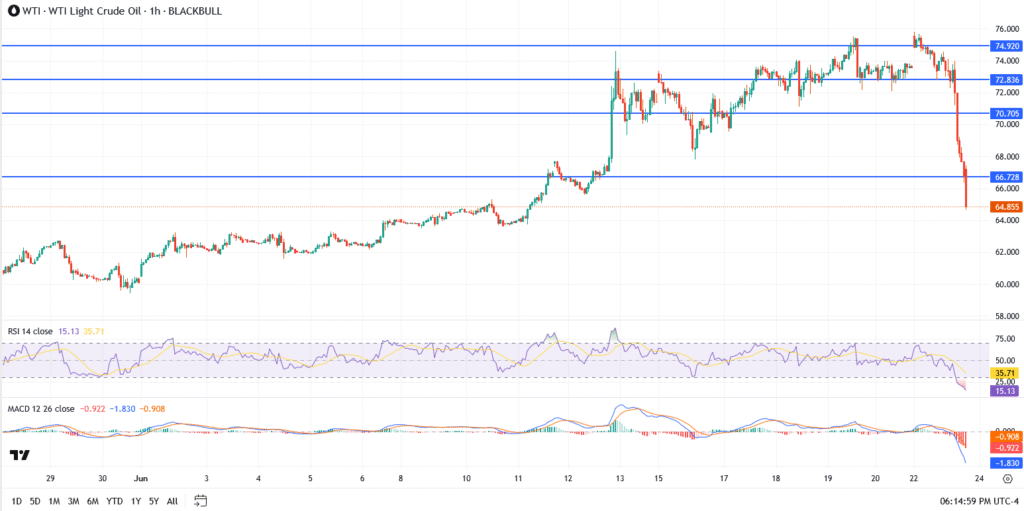

Crude oil markets unraveled late Monday night after Iran fired a barrage of missiles at a U.S. air base in Qatar. It was the first direct retaliation since American airstrikes hit three of Iran’s nuclear facilities over the weekend. While no injuries were reported and the attack spared energy infrastructure, West Texas Intermediate (WTI) crude still collapsed by over 14% from recent highs, falling from near $75.50 to trade at $64.85 per barrel by 1:20 a.m. EAT Tuesday.

According to Qatar’s defense ministry, the missile strike was intercepted before causing damage. But the sheer scale of the price swing, nearly $10 per barrel in less than 12 hours, underscored how sensitive markets remain to Middle East tensions. Oil initially spiked 6% on fears that Tehran might escalate further by threatening the Strait of Hormuz, through which nearly 20% of the world’s crude flows. But once it became clear the response was symbolic, sentiment reversed sharply.

Why Did Oil Prices Crash 14%? Key Events Driving the WTI Selloff

- WTI oil fell over 14% from Monday’s peak, dropping below $65

- Iran launched missiles at the U.S. Al Udeid base in Qatar. No casualties, no energy assets hit

- $10 intraday swing reflects extreme volatility

- Kuwait, Bahrain, and Iraq closed airspace temporarily, weighing on demand outlook

- Trump pushed for more U.S. drilling, adding political pressure to energy prices

- U.S. crude prompt spread surged to $2.24, then sharply retraced

Oil Market Reacts to Iran Strike, Airspace Closures and Trump’s Drilling Push

Despite the strike, the oil complex responded not with fear but with fatigue. Traders had positioned for the worst. When it didn’t come, the market unraveled. The selling pressure intensified as airspace restrictions across Kuwait, Bahrain, and Iraq raised concerns about fuel demand from aviation and freight, further dragging sentiment.

Meanwhile, President Trump posted a late-night warning about rising gasoline prices, calling on the Energy Department to authorize new drilling “immediately.” Energy Secretary Chris Wright responded publicly, stating, “We’re on it.”

WTI Crude Oil Technical Analysis

- Current price: $64.85

- Resistance: $68.30 and $70.00

- Support: $62.50, then $59.90

WTI Outlook After Iran Strike

Oil is now in oversold territory, but that doesn’t mean the floor is in. The measured nature of Iran’s strike may have calmed immediate supply fears, but the geopolitical chessboard is still active. If Tehran escalates or if Israel re-engages, sentiment could flip again fast. For now, WTI is caught between war headlines and macro uncertainty, and traders are choosing to de-risk.